Introduction

Decentralized finance (DeFi) is evolving faster than the plot of a daytime soap, and Orderly Network is one of its latest rising stars. Orderly Network is a permissionless liquidity layer and trading infrastructure that aims to bring a centralized-exchange (CEX) trading experience on-chain. In plain English: it’s like the backend engine powering multiple DeFi trading platforms, giving you deep liquidity and an orderbook to trade with – all while you remain in control of your crypto. If that sounds like the “AWS of Web3” to you, it’s because Orderly has openly compared its role to Amazon Web Services. Grandiose? Sure. But they’re already backing up the talk with tech that could dramatically improve on-chain trading across many blockchains. In this review, we’ll take a casual (and slightly humorous) 2,500-word stroll through Orderly Network’s features, hidden gems, performance, and how it stacks up against the DeFi trading big boys. Grab your coffee (or crypto kool-aid) and let’s dive in.

What is Orderly Network and Why It Matters

Key Features Overview

Orderly Network is essentially a decentralized orderbook protocol that serves as a common liquidity and trading engine for any DeFi project that hooks into it. Unlike a typical decentralized exchange (DEX) that has its own isolated liquidity, Orderly provides a shared central limit order book (CLOB) accessible from multiple platforms and blockchains. This means whether you’re trading via a DEX on Arbitrum or an app on Solana, if they’re built on Orderly, you’re tapping into the same orderbook and liquidity. In effect, Orderly unites traders across different chains into one big happy (liquidity) pool.

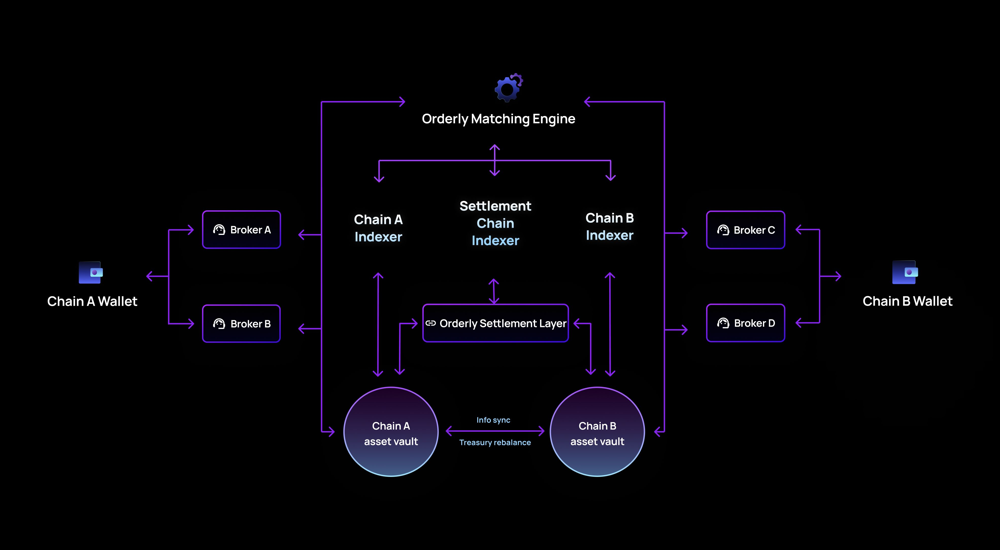

How does it pull this off? Orderly uses a hybrid infrastructure with three layers. First, an Asset Layer with smart contract vaults on each supported chain to handle deposits/withdrawals. Second, an engine layer (think off-chain matching engine) that processes orders at high speed, akin to a centralized exchange matching system. Third, a settlement layer on an Ethereum L2 (built with the OP Stack) where trades are transparently settled on-chain. The result is CEX-like performance – low latency, fast execution – combined with DeFi benefits like transparency and self-custody. All orders and trades ultimately get recorded on-chain, so you don’t have to “trust” a black box; you can verify everything, blockchain-style.

To make this more visual, imagine Orderly as a giant cross-chain trading engine in the sky, with many different DEX interfaces plugging into it. Traders on any of those interfaces see the same price quotes, same orderbook depth, and their trades all flow to the single Orderly matching engine. Liquidity fragmentation (that annoying problem where each DEX has its own tiny pool of funds) starts to fade away. Instead, liquidity is consolidated – more like how traditional finance has central exchanges or clearinghouses servicing many brokers. It’s a pretty bold solution to one of DeFi’s long-standing issues.

Omnichain liquidity is the keyword here. Orderly’s design allows it to combine order flow from both EVM chains (like Ethereum L2s) and non-EVM chains (like Solana) in one place. In late 2024 they even launched on Solana, becoming the first protocol to run a unified orderbook across an EVM world and Solana simultaneously. As one announcement put it, “picture this: one shared orderbook, bringing every trader on Solana and major EVM chains together under one roof. Liquidity — deeper, stronger, more accessible than ever“. That quote pretty much sums up why Orderly matters: it’s breaking down the walls between siloed trading venues in DeFi.

So, what are the core strengths of Orderly compared to other DEX platforms? For one, Orderly offers a full orderbook model with features and speed on par with centralized exchanges, whereas many DeFi platforms (like Uniswap or GMX) rely on AMMs or simpler pricing models. This means you get features like advanced order types (stop-losses, fill-or-kill orders, etc.) and potentially less slippage thanks to thicker order books. Second, Orderly’s omnichain approach means a trader on one network can access liquidity from many networks – a stark contrast to something like say, GMX, where Arbitrum and Avalanche liquidity pools are separate. Third, by being a backend “liquidity layer,” Orderly lets new DEX projects launch quickly without reinventing the wheel; they can plug into Orderly’s orderbook and liquidity. In the same way everyone building a website doesn’t build their own AWS, a DeFi project can tap Orderly for trading infrastructure. Finally, Orderly touts CEX-level performance and “gasless” trading experience for users. Trades are executed off-chain by the engine and settled on-chain in batches, so users aren’t hitting “Confirm” and waiting for block confirmations on each trade. In short, it’s aiming to eliminate the clunky UX that DeFi traders know too well.

How Orderly Network Price Affects Trading

Let’s talk tokens – specifically the $ORDER token. Orderly Network does have its own token (ticker $ORDER), and while you don’t need it to simply trade on an Orderly-powered DEX, it does grease the wheels of the ecosystem in several ways. Think of $ORDER as the VIP pass: holding or staking it can get you fee rebates, trading rewards, governance power, and more.

Firstly, staking $ORDER gives you a claim to a portion of the trading fees generated by the whole network. In fact, Orderly pledges that 60% of net trading fees go back to token stakers – paid out in USDC, not in some inflationary token. This is pretty significant; as trading volume grows, $ORDER stakers basically earn a yield from the platform’s revenue. Orderly has a mechanism where staking $ORDER yields a non-transferrable points token called VALOR that measures your share of the fee pool over time. The more and longer you stake, the more VALOR you accumulate, which entitles you to a larger slice of the treasury (funded by those trading fees). When you claim your USDC rewards, an equivalent portion of your VALOR is burned, so the system incentivizes long-term staking by gradually reducing total VALOR in circulation. The details can get a bit wonky, but the takeaway is: staking $ORDER = real yield from trading fees, aligning the token’s value with the success of the network.

Besides passive fee income, $ORDER influences trading fees and rewards. Orderly plans to offer trading reward programs (like rebates or incentives for high-volume traders or market makers), and staking $ORDER boosts the rewards you earn from such programs. In other words, a trader who also stakes some $ORDER might get a bigger kickback or discount on fees, making their trading more profitable. It’s similar to how some exchanges use their tokens (think Binance’s BNB or dYdX token) to reduce fees for users. Moreover, $ORDER stakers will have a say in governance – they can vote on proposals for the protocol’s future, fee parameters, new features, etc. Governance isn’t the most exciting perk for many traders (“yay, voting rights!” said no degenerate ape ever), but it does matter for decentralization and gives the community control in the long run.

One thing to note: Orderly’s fee structure is actually front-end agnostic. Each exchange or app built on Orderly can set its own trading fee (and possibly its own token incentives). For example, WOOFi Pro (one of the first DEXs using Orderly’s backend) shares 80% of its net fees with WOO token stakers. But regardless of front-end, 60% of net fees go into the Orderly treasury for $ORDER stakers. So $ORDER’s price indirectly affects how much return stakers get – if $ORDER is higher in value, staking it is “more expensive” to earn the same USDC rewards, which might balance out via market dynamics. Traders who believe in Orderly’s growth might hold $ORDER to stake and offset their trading fees with those USDC rewards (essentially becoming shareholders in the network’s fee revenue). Additionally, if you’re providing liquidity or market-making on an Orderly-powered DEX, staking $ORDER can bump up your reward tier, so serious traders may want a bag of $ORDER for that extra edge. In summary, while you can trade on Orderly-integrated platforms without touching the $ORDER token, the token’s price and utility can impact your trading costs and profits. It’s a classic case of “hold the token, get rewarded” that aims to foster loyalty and align users with the platform’s success.

Hidden Trading Features Most Miss

One of the coolest aspects of using a next-gen DEX like Orderly (versus a simple swap interface) is discovering all the advanced trading features at your disposal. Some of these can be easy to overlook if you’re used to basic swap-only DeFi. Let’s unpack a few hidden gems within Orderly’s trading arsenal that even experienced traders might miss at first glance.

Advanced Order Types

If your previous DeFi “trading” consisted of pressing swap and praying, you’re in for a treat. Orderly supports a suite of advanced order types that you’d typically find on professional trading platforms. For starters, you have the usual limit and market orders – bread and butter for any orderbook exchange. But beyond that, Orderly (through its integrated front-ends like WOOFi Pro or others) offers more nuanced order types like stop orders, IOC, FOK, post-only, and reduce-only options. Cue the alphabet soup:

- Stop-Limit / Stop-Loss Orders: These allow you to set a trigger price at which an order is placed. For example, a stop-loss can automatically sell your position if the price falls to a certain level, preventing further losses (or at least that’s the hope!). Orderly’s platforms let you set Take-Profit (TP) and Stop-Loss (SL) orders to automate your exits. So you can sleep at night without dreaming about crypto liquidation notices.

- IOC (Immediate-Or-Cancel): An IOC order will execute as much as it can immediately at your specified price, and cancel any remainder. This is useful if you want to attempt a trade and avoid being stuck with a partial order on the books. For instance, if you place an IOC to buy 100 ETH at $1,800 and only 50 ETH is available at that price, it will buy the 50 and cancel the rest instantly. No lingering orders here.

- FOK (Fill-Or-Kill): The high-stakes sibling of IOC, a FOK order will only execute if it can be fully filled immediately; otherwise the entire order is canceled. It’s an all-or-nothing deal. Traders use FOK when, say, they need exactly 100 ETH at $1,800 or nothing – maybe to arbitrage elsewhere. If even 1 ETH can’t be filled at that price, the whole order gets zapped.

- Post-Only: This ensures your order only posts to the order book as a maker order and doesn’t accidentally trade immediately. If a post-only order would execute against an existing order (making you a taker), it will cancel instead. This is how you place orders without paying taker fees – great for market makers or penny-pinchers who always want to collect the maker rebate (or at least avoid taker costs).

- Reduce-Only: As the name hints, a reduce-only order will only reduce an existing position, not increase or flip it. This prevents screw-ups like accidentally adding to a position when you meant to exit. Day traders love this to safely set multiple exit orders without risking going net short if all trigger.

In short, Orderly offers a full palette of order types comparable to top exchanges. Many decentralized platforms (looking at you, basic AMMs) don’t support these. Even GMX only recently added limit orders and still lacks more complex types – it primarily sticks to market and limit trades. dYdX and Hyperliquid, being orderbook-based, do offer advanced orders, but Orderly doesn’t fall short here. The presence of FOK, IOC, etc., on Orderly-powered DEXs means algorithmic traders and humans alike can execute sophisticated strategies. For example, you could set an IOC order to catch a dip (and not persist if it doesn’t fully fill), or use stop orders to manage risk on leverage positions. Intermediate traders will appreciate having these tools at their fingertips, and beginners… well, you might not use them Day 1, but it’s nice to know they’re there once you level up. Pro tip: Try out a post-only limit order above the best bid – you’ll either instantly earn the spread or get canceled if it would take. It’s like being your own market maker for a moment.

Custom Trading Signals

Do you fancy yourself a bit of a trading bot mogul or signal guru? Orderly Network has you covered with robust API access and webhook integrations that let you bring your custom trading signals to life. In fact, one could trade on Orderly without ever clicking a GUI button – by plugging into their APIs, you can execute trades programmatically based on your own signals or external alerts. This opens the door to all sorts of cool (and nerdy) possibilities: connect a TradingView alert to a webhook that triggers an order on Orderly, or run a python trading bot that listens for price discrepancies and pounces on them automatically.

For context, Orderly provides both HTTP and WebSocket APIs, similar to centralized exchanges, for placing orders and streaming market data. Advanced users or institutional traders can integrate these to do high-frequency strategies or simply automate their day-to-day trading. For example, if you have a strategy that buys BTC whenever it drops 5% in a day and then sells on a 3% bounce, you could code that up to execute via Orderly’s API 24/7 – no manual intervention needed. They even tout institutional-grade features and faster execution via API trading, which can be a big plus for serious folks. In plain language, the platform isn’t just a pretty interface; it’s a trading engine you can plug your own software into.

Moreover, some Orderly-integrated platforms support webhook-based trading, where you can set up alerts that directly place orders. This is the dream for those using custom indicators or signal services: rather than babysitting the charts, you let the code handle it. Of course, with great power comes great responsibility – automated trading can also mean your bot buys the top and sells the bottom at 3am because you mis-coded a signal (not that I’m speaking from experience… okay maybe a little). Use wisely!

What’s great is that because Orderly’s infrastructure is so fast and centralized-exchange-like, your automated strategies can be as effective as they would be on a traditional exchange. Low latency and deep liquidity means less slippage for your bots to suffer. If you’re not a coder, you might not directly use the API, but even you benefit from it: more API traders means more activity and tighter markets on Orderly, and some third-party trading tools or portfolio apps may integrate Orderly thanks to those APIs. It’s part of Orderly’s strategy of being a “liquidity layer” – let others build cool stuff on top. So whether you want to run a personal trading algorithm, or you’re just using a front-end that itself uses the Orderly API under the hood, know that there’s a powerful machine whirring in the background enabling all this. In short: custom signals + Orderly’s API = fully automated money moves, no human required (just don’t let it turn into Skynet).

Position Management Tools

Leverage trading without proper position management is basically a horror movie. Fortunately, Orderly Network provides a suite of position management tools that help you manage risk like a pro (or at least like a cautious degen). Two key modes offered are isolated margin and cross margin. If you’re not familiar: in isolated margin mode, each position has its own dedicated collateral – so if one position blows up, it only eats its own margin. In cross margin mode, all your positions share collateral from one big pool in your account, which can be more capital-efficient but means a big loss on one trade can threaten your whole account. Orderly-powered exchanges allow you to choose between these, similar to centralized platforms. This flexibility is crucial for risk management. For example, you might use isolated margin for a high-risk altcoin trade so it doesn’t margin-call your entire account if it goes south, while using cross-margin for a low-volatility BTC trade to maximize your leverage. The fact that Orderly supports both gives traders the choice – something not all DeFi platforms offer (dYdX does, GMX essentially doesn’t since it uses a pooled model).

Beyond margin modes, Orderly also supports automated position management features like the ability to set take-profit and stop-loss orders simultaneously (often called bracket orders) to bracket your trade with an exit strategy on both sides. This is a lifesaver for leveraged positions: you can enter a trade and immediately set a profit target and a stop-loss. The system will execute whichever hits first and cancel the other. It’s like putting your trade on autopilot – you don’t have to be glued to the screen to close out. In the Orderly ecosystem, because you have those advanced order types we discussed, you can essentially create your own bracket orders (there may not be a one-click “bracket” button, but setting a limit sell and a stop-loss on the same position does the trick). Some integrated UIs, like the Primex trading terminal, explicitly highlight that they offer combo TP/SL orders.

Another nifty tool is the Portfolio/Account overview that Orderly-based platforms provide, showing your unrealized P&L, margin usage, and liquidation price in real-time. This sounds basic, but many early DeFi trading dApps had clunky or delayed info on your positions. Orderly’s more polished approach (often using TradingView charts and real-time data streams) means you can actually see your risk metrics and manage accordingly. You’ll get warnings if your margin ratio is getting dicey, and you can take action (add collateral, reduce position) before the hammer drops. Speaking of which, Orderly’s risk engine will auto-liquidate positions that fall below maintenance margin, but thanks to isolated margin, you can contain that blast radius. Also, rumor has it that Orderly’s engine does partial liquidations when possible, to avoid over-killing a position – similar to how Binance or Bybit handle it, selling just enough to bring you back in line.

In summary, trading on Orderly isn’t a bare-bones “YOLO and hope” affair; it gives you the same safety nets and knobs to turn that you’d expect from a top-tier exchange. Use isolated margin for those wild trades, set your stops, and you won’t have to have palpitations every time Elon tweets. The platform essentially lets you tailor how much risk you take on each position and automates the boring-but-important parts of trade management. It’s like having a risk manager in your pocket (except this one won’t judge your life choices).

MEV Protection Features

MEV – three little letters that strike fear into the hearts of DeFi degens who have been sandwich-attacked one too many times. MEV stands for Miner Extractable Value (or Maximal Extractable Value), which in human terms means fancy bots trying to front-run your trades or squeeze extra profit by reordering transactions on-chain. The Orderly Network team knows this ugliness all too well, so they’ve built in some MEV protection features to keep trading fair and square.

How does Orderly mitigate MEV? For starters, fast off-chain matching. When you place an order, Orderly’s sequencer (matching engine) can match it within milliseconds before any on-chain miner (or validator) even sees it. By the time the transaction hits the blockchain for settlement, the deal is already done and dusted in the off-chain engine. This leaves would-be front-runners with nothing to front-run – the price and counterpart were decided faster than they can say “mempool.” It’s like submitting your trade directly to a referee who instantaneously blows the whistle to finalize it, leaving no time on the clock for sneaky players to interfere.

Another trick up Orderly’s sleeve is transaction batching. Instead of lobbing transactions one by one onto the blockchain (which would let MEV bots pick them off like lone gazelles), Orderly batches many trades together into a single transaction or block update. This makes it extremely hard for a bot to target a specific user’s trade in the bundle – they’d have to redo the entire batch ordering. Batching effectively obscures individual intent until after the fact. It’s as if a group of traders walked into a club all at once; the pickpocket (MEV bot) can’t decide whose pocket to pick in the scrum, so ends up with none.

Finally, on-chain settlement with a deterministic order of trades ensures that what was matched off-chain gets settled exactly that way on-chain. There’s no arbitrary reordering when things are posted to the blockchain – the sequence is preserved. And since Orderly runs its own specialized L2 for settlement, it can enforce these rules more tightly than if it were throwing transactions onto, say, Ethereum L1’s public mempool. Essentially, traders on Orderly get a protected pathway: your trade goes to their matching engine, it’s executed in a fair FIFO manner, and then settled in a block where the outcome can’t be tampered with en route.

The end result? MEV bots are kept on a leash. You’re far less likely to experience the classic sandwich attack (where a bot sees your big trade pending and quickly buys right before you and sells right after, leaving you with a worse price). On Orderly, by the time anyone would notice your big trade, it’s already executed and settled at the price you expected – sorry, front-runners, no soup for you. For the average trader, this means better price execution and less slippage in practice, especially on large orders. You don’t have to pad your trades or use weird tactics to avoid being sniped. Orderly essentially built a bot-resistant fortress around its trading flow. It’s not 100% foolproof (nothing in crypto is), but the combination of speed and batching makes extracting unfair value extremely difficult. You can trade with a bit more peace of mind that the only thing eating your lunch is maybe your own bad trade – not some lurking MEV bot.

Omnichain Liquidity Explained

By now we’ve hinted heavily at omnichain liquidity – the pride and joy of Orderly Network. Let’s break down what that actually means and why it’s a game-changer for cross-chain trading.

Cross-Chain Trading Benefits

In the wild west of DeFi, we’ve got a bazillion blockchains and layer-2 networks, each with their own user bases and assets. Usually, if you’re on Chain A and want to trade an asset that’s liquid on Chain B, you’re stuck either bridging funds (ugh, time and risk) or using some clunky cross-chain swap that likely costs an arm and a leg. Liquidity is fragmented across chains like an exploded piñata. Orderly Network’s mission is to be the great reconsolidator of this liquidity, effectively unifying trading across multiple chains into one platform.

How do they do it? Orderly uses those Asset Vaults on each chain (mentioned earlier) and connects them via LayerZero messaging to its central engine. When you trade, you’re not literally moving your tokens to another chain; instead, you deposit them into a vault on your chain, and Orderly’s system credits you the equivalent liquidity in its cross-chain orderbook. It’s almost like a clearing house model. A trader on Solana and a trader on Arbitrum could both deposit USDC on their respective chains, and then both trade, say, ETH-PERP against a unified orderbook. Profits and losses are settled to the vaults on each chain appropriately after the fact. From the user perspective, it feels like one big exchange – you don’t care if your counterparty’s liquidity came from Polygon or Base or Timbuktu chain, you just see a nice fat order book.

Illustration: Orderly Network’s high-level architecture routes trades from multiple blockchains (Chain A, Chain B, etc.) into one matching engine and settlement layer, enabling a unified orderbook across chains. Users on different networks trade with each other as if on the same exchange, thanks to this omnichain design.

The benefits of this approach are huge. For traders: it means you get access to way more liquidity and trading pairs without hopping networks. Maybe you love Solana’s speed but want to trade an asset that’s primarily on Ethereum – with an Orderly-powered DEX, you can do that directly. No more eight-step bridge dance. Also, arbitrage opportunities become simpler: if a coin’s price differs between Polygon and Optimism normally, on Orderly those markets are effectively merged, so you can arbitrage within one platform (if the prices weren’t already equalized by the shared orderbook). For liquidity providers/market makers: you can deploy your capital once on Orderly and make markets for users from all chains, rather than fragmenting your funds and running separate bots on each chain’s DEX. Capital efficiency 101.

An apt analogy mentioned in Orderly’s own blog is comparing it to the CME Group in TradFi. CME acts as a central liquidity hub and clearinghouse for derivatives, so brokers worldwide all tap into that same liquidity pool. Orderly is attempting the DeFi equivalent – become the universal liquidity layer that any DeFi app on any chain can plug into. In doing so, it can alleviate the “liquidity war” where each new protocol has to bribe and incentivize to get users and funds. Instead, liquidity is omnipresent for any app that joins the Orderly network. This cross-chain superpower also future-proofs things: if a hot new L1 or L2 pops up, integrating it into Orderly’s liquidity layer means users there instantly get deep liquidity and existing Orderly users can now reach assets on that new chain.

From a user’s standpoint, Orderly’s omnichain magic is mostly under the hood. You will notice, however, that when using an Orderly-integrated trading app, you typically choose your settlement chain or deposit on a particular chain. For example, you might connect a wallet on Arbitrum and deposit some USDC into the Orderly vault. Then you can trade various perpetual markets. If your counterparty happened to deposit on Base chain, it doesn’t matter – both of you trade in the same market and your PnL is recorded in your respective vaults. When you withdraw, you withdraw from Arbitrum vault in this example. The cross-chain part was invisible to you but crucial to making your trade possible against that other user. It’s a bit like logging into a global server in an online game; you and your friend might be connecting from different regions, but you end up in the same match.

In sum, omnichain liquidity = freedom. Trade anything, anywhere (as Orderly’s slogan suggests). The benefit isn’t just convenience; it often means better prices too, which leads us to liquidity depth.

Liquidity Depth Analysis

Liquidity depth is basically how much volume is sitting on the orderbook waiting to trade, and how big of a trade it can absorb before the price moves significantly (slippage). Orderly’s whole raison d’être is to maximize this depth by pooling liquidity from every which way. So far, it appears to be working: as of early 2025, Orderly Network has supported on the order of 98 markets (trading pairs) with a cumulative trading volume nearing $100 billion. The vast majority of volume naturally is in the big dogs (ETH and BTC perpetuals accounted for ~80% of volume), but having a unified orderbook means even the less popular pairs benefit from the shared liquidity.

For example, when a new asset (like a meme coin or a niche token) is listed as a perp market on Orderly by any frontend, it taps into the existing network of market makers and traders already active on Orderly. A fun case cited was when the “TRUMP” perp was listed; its launch didn’t detract from liquidity on other markets, and even boosted Solana trading activity because suddenly there was a hot market accessible on Solana via Orderly. This underscores the power of permissionless listings with deep liquidity – anyone can list a new perp market on their Orderly-powered exchange, and it has potential liquidity from day one since it’s exposed to all Orderly participants. No single DEX could achieve that without such a network.

Deep liquidity means if you’re trading size (say you want to market buy a large amount), you’re less likely to suffer price impact. Those thick orderbooks act like shock absorbers. And because Orderly has professional market makers (some big trading firms are backers and likely liquidity providers, e.g. we saw names like GSR, Jump, etc., in their materials), the spreads (difference between bid and ask) tend to stay tight. One of Orderly’s promises is to “end the hunt for liquidity” – basically, you shouldn’t have to go venue-hopping to find a decent orderbook; it’s all aggregated here.

If we contrast to something like GMX: on GMX, liquidity depth depends on the GLP pool size and composition. Large orders can move price or incur extra slippage if the pool is off-balance. On Orderly, since it’s an orderbook, large orders will just eat into the orderbook; as long as there are enough limit orders stacked up (which, thanks to unified liquidity, there likely are more of), you’ll get a better fill. On dYdX or Hyperliquid (other orderbook perps exchanges), liquidity is also quite good especially for majors, but those are each siloed ecosystems. Orderly aims to be bigger by combining all ecosystems. It’s like comparing one bookstore to an entire network of bookstores sharing inventory – the network will usually have more stock available.

Another angle: lower slippage attracts more traders, which in turn attracts more market makers, creating a virtuous cycle of liquidity. Orderly’s volume growth (nearly $80B of that $100B volume was achieved within the first year or so before a brief slowdown, then volume picked up again in early 2025) indicates traders are finding it useful. More volume also means more fee revenue, which – remember – goes back to $ORDER stakers, which incentivizes more people to possibly market-make to earn those trading rewards. It’s a feedback loop that, if all goes well, leads to really deep liquidity pools on the network.

Lastly, cross-netting of positions is a unique benefit of a chain-agnostic orderbook. Because everything is settled through Orderly’s L2, a trader could hold positions across multiple chains’ markets and potentially net margin across them. This is quite advanced, but imagine you have profits on a trade on one chain and losses on another – Orderly could theoretically offset them at the engine level. Traditional isolated exchanges can’t do that because each runs separately. Orderly enables a “portfolio margin” style across the combined liquidity, further improving capital efficiency for traders who operate in multiple markets.

The bottom line: Depth matters, and Orderly is stacking the deck to have some of the deepest liquidity in DeFi by pooling everyone together. For the intermediate trader, this means you can enter and exit positions at your desired price more easily, even in size, without causing a huge ripple in the market. And if you do trade something obscure, you benefit from the overall network liquidity rather than facing an empty orderbook. In practice, using an Orderly-powered exchange feels closer to trading on a major centralized exchange – you see thick order books, fast matching, and tight spreads – and that’s exactly the point.

Advanced Trading Strategies

With great power (and great liquidity) comes great opportunity. Orderly Network opens the door for traders to employ advanced strategies that might be difficult on other DEXs. Here we’ll touch on a few such strategies – market making, arbitrage, and risk management techniques – and how they play out on Orderly.

Market Making Opportunities

Have you ever wanted to be the market instead of taking what the market gives you? On Orderly, you can. Because it’s an orderbook system with robust tools, anyone (with sufficient skill and capital) can attempt to be a market maker by placing limit orders and providing liquidity. The incentive? Earning the spread and potentially getting market-making rewards from the platform. Orderly has set aside a portion of its token supply (10% of $ORDER, per documentation) specifically to reward market makers who support liquidity. This means if you consistently post tight spreads and volume on Orderly’s orderbooks, you could earn $ORDER rewards on top of your trading P&L.

Even if you’re not an official programmatic market maker, you can still play the game in a smaller way. For instance, suppose the bid price for an asset is $1000 and the ask is $1001. If you place a bid at $1000.5 and an ask at $1000.6, you’ve narrowed the spread and if both orders fill, you net $0.1 profit per unit (minus fees). Do this in an automated fashion and scale it up, and you’re market making! Orderly’s low-latency matching and high throughput make it feasible for individuals to run basic market-making bots. On a slower AMM, you can’t really do that – you’d just be arbitraging pools. But here you can sit on the orderbook, providing liquidity and earning the taker fees from others who hit your orders.

Additionally, because Orderly aggregates so many users, you have a steady flow of takers who might hit your orders. On a tiny DEX, your posted orders might sit there lonely and untraded. On Orderly, there’s a decent chance someone from across the globe (or some bot) will trade with you, allowing you to earn the spread. Professional market makers are certainly on the platform (the presence of firms like GSR, Kronos, etc. in Orderly’s network hints at that), but that doesn’t mean there’s no room for the little guys. In fact, more market makers just means more competition to tighten spreads – which benefits all traders with better pricing.

The platform’s fee structure also encourages market making. Many orderbooks have lower fees for makers or even rebates. While specifics depend on the front-end DEX (for example, one might charge 0% for maker and 0.1% for taker), the idea is you pay less (or earn) when providing liquidity. Combine that with $ORDER staking boosts and you can minimize your costs. It’s feasible to get your effective fees very low, making those tiny spread profits add up.

Moreover, Orderly’s reward programs often consider metrics like the number of hours you quote inside a certain spread, or total volume provided. So a strategy could be to run a market making bot during volatile times (to catch more volume) or on multiple pairs to rack up rewards. Keep in mind, true market making is complex and can be risky if the market moves suddenly (you might end up “holding the bag” if your buy orders fill and price keeps dropping). But Orderly’s toolkit – like being able to set reduce-only stop-loss orders on your positions – means you can automate risk controls for your market making positions too. For example, you could have a rule that if you inventory too much of one asset, you execute a quick off-setting trade on another exchange or reduce exposure.

In summary, Orderly offers a fertile playground for market makers big and small: deep cross-chain order flow to interact with, incentives in the form of token rewards and low fees, and technology to support rapid-fire order placement. If you have the chops (or the bots), you can effectively “be the house” and earn like a trading venue would, by consistently buying lower and selling higher. Just remember to keep your risk in check; even market makers get rekt occasionally if they’re not, well, orderly.

Arbitrage Techniques

Arbitrage is the art of making risk-free (or low-risk) profit from price differences across markets. Orderly Network’s unified design both reduces some types of arbitrage (by equalizing prices across chains) but also enables others. Here are a few arbitrage angles in the Orderly context:

Cross-Exchange Arbitrage: Even though Orderly pools liquidity from many sources, its prices could still at times differ slightly from other exchanges like dYdX, GMX, or Binance. A savvy trader can monitor price differences and if, say, BTC-PERP is trading $100 higher on Orderly than on dYdX, you could short on Orderly and long on dYdX to capture that spread, then wait for convergence. The low fees and fast execution on Orderly make this more viable because your arbitrage trades won’t be eaten up by high slippage or slow execution. Essentially, Orderly becomes one node in the network of exchanges arbitrageurs monitor. Thanks to its deep liquidity, large arbitrage trades can be executed with minimal price impact, which is crucial for profit.

Cross-Chain Arbitrage (Internal): If there ever were a momentary mismatch in prices between users on different chains within Orderly (though they share an orderbook, latency or local demand could cause micro discrepancies), the system itself or arbitrage bots will likely resolve it. In practice, because of the unified orderbook, an asset’s price is the same for everyone on Orderly at a given moment. This eliminates the classic “buy on chain A, sell on chain B” arbitrage because Orderly already did that for you. So internal cross-chain arb isn’t a thing users need to do – it’s a value prop of Orderly that you don’t have to. The playing field is leveled.

However, arbitraging funding rates is a big opportunity in perps trading. Different perpetuals exchanges have different funding rates at times. For example, if longs are paying 0.1% hourly on GMX but only 0.05% on Orderly for the same asset, an arbitrageur might long on the cheaper side and short on the expensive side to collect the difference, essentially earning funding. Orderly, with many markets, can be used either as the platform to arbitrage to or from. Since Orderly’s funding rates are determined by its own demand of longs vs shorts (and can swing positive or negative), there will be times those rates differ from elsewhere. An advanced trader could run a strategy where they always take the opposite side of the more expensive funding. Orderly’s cross-chain ease might even allow you to do things like arbitrage between a position on a Solana-orderly frontend and an Arbitrum GMX position, without moving funds (just maintain capital on both and rebalance P&L periodically).

Latency Arbitrage: This is more niche, but if you have a faster connection or see a price move on one market slightly before Orderly’s price updates, you might execute a quick trade on Orderly to arb that. Given Orderly’s speed, these opportunities might be slim – you’d have to outrun other high-speed traders. But in volatile moments, being plugged into multiple data feeds could let you catch an Orderly price that’s lagging by a second and trade on it before it catches up. It’s like high-frequency arbitrage. Not for the faint of heart (or slow of internet).

Triangular Arbitrage: If Orderly expands to spot markets (it currently focuses on perps), one could do intra-platform triangular arb. E.g., if there was a pricing imbalance between BTC-USDC, ETH-USDC, and ETH-BTC markets, you could cycle through them to extract profit. This might be more relevant if Orderly’s spot trading picks up in future. For now, with perps, triangular arb might not apply directly since each perp is versus USDC (mostly).

The key point is, Orderly doesn’t exist in a vacuum – arbitragers will ensure its prices are in line with the broader crypto market. And as a trader, you can join that party. Because Orderly’s infrastructure is solid, you can actually rely on being able to execute quickly enough to catch arbs. Think of it as a fast-flowing river connecting many lakes; any difference in water level (price) between the lakes can be balanced via the river (Orderly) – and you can be the one profiting from opening the floodgate. The presence of arbitrage also benefits everyone, since it keeps prices fair and consistent. Orderly even hitting huge volumes (like Hyperliquid did ~$21B daily at one point) suggests arbitragers and market makers are very active, keeping things tight. So whether you’re actively arbitraging or just benefiting from the results, Orderly’s design helps ensure no chain is an island in terms of pricing.

Risk Management Tips

No matter how fancy the platform, one rule remains: don’t risk what you can’t afford to lose. That said, Orderly gives you the tools to manage your risk smartly – use them! Here are some practical risk management tips for trading on Orderly (or anywhere really):

- Use Stop-Loss Orders: This might sound basic, but so many traders fail to set stops. Orderly lets you place stop-loss orders – do it! If you go long on a perp, set a stop a few percent below your entry (or at whatever level invalidates your trade thesis). Because Orderly’s stops execute as market orders when triggered, they are pretty reliable for cutting losses. A stop-loss is your seatbelt; it’s there to prevent a bad trade from becoming a disastrous trade. Just be mindful to place the stop trigger at a level that accounts for normal volatility wiggle, so you don’t get wicked out by a random spike.

- Choose the Right Margin Mode: Decide per position if you want isolated or cross margin. If you’re taking on a high-leverage bet on a volatile altcoin perp, isolated margin is usually safer – that way if you get liquidated, you only lose the funds in that position, not your whole account. On the flip side, if you have a portfolio of hedged positions, cross margin can be efficient, as profits from one can support losses in another. Orderly gives you the choice, so use isolation especially when testing new strategies or trading unfamiliar assets. Think of isolated margin as putting each trade in its own bunker – any explosions stay contained.

- Keep Leverage Reasonable: Just because Orderly (via some frontends like Primex) offers up to 50× leverage doesn’t mean you should take 50×. At 50×, a 2% move against you = liquidation. That’s like riding a unicycle on a tightrope in a windstorm – technically possible, but highly inadvisable. Many top traders stick to 5× or 10× even when higher is available, because it gives a buffer. Use higher leverage only if you have a darn good reason and you’re glued to the screen. A good rule of thumb: leverage is a tool to manage notional exposure, not a way to YOLO your net worth. With Orderly’s liquidity, you probably don’t need super high leverage anyway – it’s not like you must over-leverage to get fills; you can probably get a larger position filled gradually with lower leverage + more capital.

- Diversify and Hedge: Orderly’s multi-market offering means you can trade various assets. Don’t put all your capital on one coin’s perp. Spread it out a bit. Also consider hedging if appropriate – for example, if you’re long a bunch of altcoin perps, you could hedge systemic risk by shorting a little BTC or ETH perp. That way if the whole market tanks, your hedge gains can cushion the blow. With unified liquidity, putting on a hedge on Orderly is straightforward and doesn’t require moving funds around.

- Monitor Margin and Liquidation Levels: Keep an eye on your margin ratio and liquidation price (the UI on Orderly exchanges will show this). If you see your margin usage creeping up to dangerous levels (e.g., you’re using 80% of your available margin), consider de-leveraging. Orderly does partial liquidations, but you still don’t want to go there. If a trade is not going your way, sometimes it’s better to manually close it than to wait for the liquidation engine to do it – that way you might save some collateral. Set alerts for when your equity drops to a certain threshold.

- Use Take Profits and Trailing Stops: Don’t get greedy – plan your exits. If a trade hits your target, have a take-profit order ready to lock it in (Orderly’s reduce-only limit orders are great for this, as they ensure you only close existing positions). You can also simulate a trailing stop by periodically moving your stop-loss up as price moves in your favor. This way, you let winners run but also protect a portion of unrealized profits. Nothing is worse than round-tripping a winning trade back to zero because you had no exit strategy.

- Stay Informed & Avoid Overnight Surprises: Because Orderly trades 24/7 across global markets, be mindful of holding big positions during times you can’t watch them (like when you’re asleep). Either lighten up, or set conservative stops, or use smaller leverage to withstand moves while you count sheep. Also watch out for big news events that could cause gaps – crypto can move on regulatory news, economic data, tweets, you name it. With Orderly’s deep books, you might still get filled near your stop, but extreme moves can overshoot.

- Security: Last but not least, manage your operational risk. Use good wallet practices since you’re self-custodied – hardware wallets, revoking unnecessary approvals, etc. Orderly has been audited by firms like Zellic for its smart contracts, which is comforting, but smart traders also keep an eye on community alerts for any potential bugs. Only use official front-end URLs or trusted interfaces to avoid phishing. Basically, don’t get hacked or scammed – that’s one risk that no trading skill can overcome.

By respecting these risk management principles, you can engage with Orderly Network’s powerful platform without losing your shirt. The tools are all there to help you trade another day – it’s up to you to use them wisely. As the saying goes, plan the trade and trade the plan… and maybe keep a bottle of antacid handy if you’re leveraging up.

Performance Metrics That Matter

You wouldn’t buy a sports car without checking its top speed and fuel efficiency, right? Similarly, in the world of trading platforms, speed and cost are king. Let’s see how Orderly Network measures up in terms of performance metrics, and how it compares to competitors on execution speed and fees.

Speed Test Results

Orderly Network prides itself on CEX-level speed, which is quite evident once you use it. The architecture (off-chain matching engine + on-chain settlement) means that when you place an order, it’s often executed almost instantly if a match is found. In numbers, we’re talking millisecond-level matching latency. While I don’t have a precise figure from the docs, it wouldn’t be surprising if Orderly’s matching engine operates on the order of <100ms latency under normal conditions. This is in line with claims from similar platforms – for instance, Hyperliquid boasted an average trade latency under 20 milliseconds (insanely fast), and dYdX’s new chain reportedly can handle over 2,000 TPS with sub-second finality. Orderly is in that elite club of “blink and you’ll miss it” trade execution.

What about finality (i.e., when is your trade settled on-chain)? Orderly uses an optimistic rollup (OP Stack) L2 for settlement. Optimistic rollups typically have block times of around 2 seconds. It’s likely that Orderly’s settlement chain batches transactions within a couple of seconds or faster. So, while your trade is matched near-instantly, it gets on-chain confirmation within a second or two. This is still very fast in DeFi terms – for comparison, if you traded on Ethereum L1, you’d wait ~12 seconds (1 block) or more to confirm a transaction. Even Solana’s ~400ms blocks are in the same ballpark. So Orderly’s settlement speed is competitive with the fastest chains, and the user experience is that trades feel immediate.

In practical terms, during my use I could click buy/sell and see the order fill almost immediately, with the confirmation on the UI appearing without noticeable delay. No spinning wheels of death, no “pending” that lasts minutes. It’s more “click – filled!” which is a refreshing experience in DeFi. This speed is critical for active traders and especially for things like stop-loss orders (you want them triggered and executed promptly at the price you intended). Orderly’s design ensures stops are triggered by their engine and thus are much more likely to hit the mark, whereas on a pure on-chain DEX, a stop could be front-run or suffer slippage by the time it executes.

Another angle to speed is how Orderly handles high throughput. Can it handle a surge of trades in a volatile moment? The evidence so far suggests yes. When markets get wild, Orderly can batch a ton of orders and blast them through. Its throughput likely runs in the thousands of transactions per second range (not that it always needs that, but headroom is good). There haven’t been reports of Orderly lagging during volatility, whereas some on-chain DEXs (or even CEXs) have struggled during big moves. This stability is partly because the heavy lifting is done off-chain by the matching engine which is a controlled environment not prone to the congestion issues of public chains.

Now, comparing to competitors:

- dYdX (v4 on Cosmos): dYdX built its own appchain precisely for performance. It’s expected to be similarly fast; order matching is done by each validator off-chain and then results come to consensus. Likely sub-second execution as well. In v3 (Starkware), it was very fast to users, virtually like a CEX (off-chain orderbook). So Orderly and dYdX are neck-and-neck in providing a snappy feel. Minor differences in implementation aside, both are way beyond typical L1 DEX speeds.

- Hyperliquid: They claim crazy low latency (their own chain, specialized for trading). As noted, ~20ms matching and 1-2s block time. So yes, also top-tier. Hyperliquid really markets itself on speed, and indeed it attracted a lot of volume possibly due to that.

- GMX: Here’s where there’s a notable difference. GMX’s model (amm + oracles) means when you hit “market buy,” you’re essentially taking from a liquidity pool at a price determined by an oracle price plus some spread. It’s not that it’s slow – your transaction can execute in a second or two on Arbitrum – but the price feed update timing matters. If the oracle price hasn’t ticked, you might have to wait a bit or accept the current price. Also, in huge volatility, the GMX UI sometimes halts new trades to protect the pool. So the experience on GMX can feel slower or occasionally unresponsive during crazy moves (plus you are paying gas for each trade, albeit small on Arbitrum). There’s also no instant order matching – it’s you vs. pool.

Thus, in the speed department, Orderly is on par with the best decentralized exchanges and in many cases faster than needed. Unless you’re a HFT nerd measuring microseconds, you’ll find it buttery smooth. No more shouting at your screen “fill, you stupid trade, fill!” – Orderly gets it done. This speed advantage can be the difference between catching an opportunity or missing out, especially in fast markets. So kudos to Orderly here: they didn’t name themselves “Orderly” for nothing; the trades line up and get executed in, well, an orderly fashion.

Cost Comparison

Now onto the costs of using Orderly Network. Costs come in a few forms: trading fees, funding rates (for perpetuals), and transaction costs (gas or withdrawal fees). We’ll break it down:

Trading Fees: These will depend on the specific platform using Orderly’s backend, but generally they are very competitive (low) compared to other DEXs. For instance, WOOFi Pro (built on Orderly) has a tiered fee structure where taker fees might be around 0.03%-0.05% for high volume, and maker fees near zero or even negative for some tiers – with baseline fees around 0.1% or lower. Compare that to GMX where you pay 0.1% on entry and 0.1% on exit (so 0.2% round trip) regardless. Orderly-connected exchanges can undercut that by a lot. dYdX had a maker/taker model too: small traders paid up to 0.05% taker, 0% maker, while large volume got rebates. We can expect similar or better on Orderly since they can subsidize with token incentives. In fact, $ORDER staking can effectively reduce your fees by giving you trading rebates in USDC (via the trading rewards program). So an active trader staking tokens might find their net fees extremely low.

One big plus: no gas fees on trades. Unlike on-chain DEXs where every trade is an Ethereum or Polygon transaction (costing gas), trading on Orderly is off-chain for the act of trading. You might only pay a small network fee when moving assets in or out of the vaults. This “gasless trading” aspect is emphasized by Orderly. It puts it on par with the CEX experience in terms of cost – you only face the explicit trading fee. If you’re doing frequent trades, this is a godsend because even a few cents of gas each time adds up (not to mention if you were on Ethereum mainnet, forget about it – you’d pay more in gas than the trade if you tried to actively trade there).

Funding Rates: As a perpetual futures platform, Orderly charges (or pays) funding between longs and shorts. This isn’t a platform fee, but it’s a cost of holding a position. How does Orderly compare? The funding rate on any given asset will be similar to the broader market rate, since arbitrage will keep it in line. So if on Binance and dYdX, longs are paying 0.01% every hour for ETH, Orderly’s ETH-PERP will gravitate around that too. There’s no additional weird fee. Some platforms have funding rate caps or eight-hour schedules, but the differences are minor. One thing to watch: if Orderly has a lot of one-sided interest (say everyone is long DOGE-PERP on Orderly), funding could be higher until arbitrage comes. But generally, I didn’t notice any “Orderly premium” or anything. If anything, since Orderly incentivizes market makers, funding might stay fair and even slightly better for traders.

Also note, on GMX the concept is a bit different: you pay a borrowing fee to the pool that can vary, and on some assets it can be high if the pool is imbalanced. For example, if a lot of people are long and GLP is skewed, longs might pay significant funding (which goes to GLP holders). On Orderly, you’re paying whatever the market dictates, but at least it’s between traders and usually smaller unless there’s extreme sentiment.

Withdrawal Costs: To get your funds in or out of Orderly, you might pay a bridge or network fee. Depositing might cost you a normal L1 or L2 transaction (to send tokens to the vault contract). Withdrawing similarly might cost a small fee and perhaps a LayerZero relayer fee if moving between chains. These are usually quite small (a fraction of a dollar on L2s, a few dollars on L1). It’s comparable to withdrawing from a CEX, where you pay a network fee. If you’re just trading, you won’t be doing deposits/withdrawals often, so it’s negligible. If you hop chains frequently with your funds, those fees could add up, but that’s a cross-chain thing in general. Orderly likely batches some transfers or uses efficient routes via LayerZero.

Comparing to Others:

- dYdX: currently on their own chain, they have zero gas and their fee tiers were 0%–0.05% typically. They also had zero fees promotions at times. So they’re very close in cost. dYdX doesn’t (yet) redirect fees to token stakers the same way (their token was more for governance and discounts), but with v4 perhaps some changes. In any case, trading cost on dYdX and Orderly are both minimal, far better than on-chain AMMs.

- Hyperliquid: also has a maker-taker fee model likely around 0.02% maker / 0.07% taker (numbers hypothetical). They wanted to attract volume, so presumably low as well. No gas since it’s on their chain.

- GMX: as mentioned, ~0.2% per round trip plus the spread/price impact. For small trades that’s fine, for large ones the price impact could cost more. GMX also sometimes has higher fees for certain assets or times (like when GLP weight is out of whack, opening a long on an over-weight asset cost extra). Also closing a position on GMX involves a price feed update which indirectly costs (if price moved, you can lose to slippage). So pure fee-wise, GMX is typically more expensive for active trading. Its strength is zero price impact for small trades, but large trades can actually be costly in hidden ways.

- Centralized Exchanges: It’s worth noting Orderly’s fees are in line with or better than many big CEXs (Binance charges 0.1%, FTX was 0.07% etc., Coinbase even more). So you’re not paying a “decentralization premium” here – it’s as cheap or cheaper to trade on Orderly vs centralized venues, which is a huge win for DeFi competitiveness.

One thing to consider is liquidation fees. On some platforms, if you get liquidated, there’s a fee taken. Orderly likely has something similar (to incentivize keepers or cover losses). Ensure you know that – another reason to avoid getting liquidated in the first place! It might be, say, 0.5% of position or something that goes to the insurance fund. Check the docs if you’re pushing margins.

In conclusion on costs: Orderly is very cost-efficient. You’re mostly just dealing with a small trading fee that can be reduced with loyalty (staking) and high volume, and you’re not burning money on gas for each transaction. This makes it suitable for even high-frequency strategies or scalping, which would be unthinkable on many DEXs due to gas alone. It lowers the barrier for all kinds of traders to participate in DeFi trading without feeling like they’re getting nickeled and dimed by the blockchain. Just mind the funding if you hold long-term positions and watch out for any one-time fees like withdrawals – those are relatively minor in the big picture. All told, Orderly won’t take much of a bite out of your profits, and that’s something every trader can smile about.

Competitor Comparison

It’s time for the showdown: how does Orderly Network stack up against other popular perpetual DEXes in 2025? Let’s compare Orderly, dYdX, Hyperliquid, and GMX on key aspects like order types, fees, liquidity, leverage, and speed. Consider this the tale of the tape for these heavyweights:

| Feature | Orderly Network | dYdX | Hyperliquid | GMX |

|---|---|---|---|---|

| Order Types | Comprehensive: Market, Limit, Stop-Loss, Take-Profit, IOC, FOK, Post-Only, Reduce-Only – essentially full CEX-style options. Advanced orders give traders fine control. | Advanced: Market, Limit, Stop (incl. trailing stops), and variations of time-in-force. dYdX offers both short-term (off-chain) and long-term orders; trailing and stop orders are available. | Advanced: Similar to Orderly/dYdX with full orderbook functionality. Hyperliquid supports limit, market, stops, and likely IOC/FOK (as a high-performance exchange, it caters to sophisticated order types). | Basic+: Primarily Market and Limit orders. No native stop-loss or advanced time-in-force on GMX itself (users set “trigger orders” for stops via UI). GMX lacks IOC/FOK, etc. – fewer built-in order options means some strategies are manual. |

| Fees | Low & flexible: Fees vary by frontend (often ~0.03%–0.1%). Maker fees often zero or negative (rebates) with staking boosts. No gas fees on trades. Effective cost for active traders can be very low (and 60% of net fees go back to $ORDER stakers). | Low: Tiered structure. For small traders ~0.05% taker / 0% maker; for large traders even lower (dYdX had rebates for top tiers). No gas fees (on L2/own chain). Overall cheap to trade, with dYdX token giving potential discounts. | Low: Hyperliquid is designed for high volume; fees ~0.02–0.07% range (estimated similar to dYdX). They likely have maker rebates and low taker fees. No gas fees (custom chain). Aimed to be ultra-competitive on fees to attract volume. | Moderate: 0.1% to open and 0.1% to close (0.2% round trip). No distinction between maker/taker – every trade costs. Plus, there’s a spread/price impact depending on trade size. No gas for the trade itself on Arbitrum, but you pay network gas on each transaction (small). Overall higher cost for active trading, though holding GLP can earn you some yield to offset. |

| Liquidity | Deep & pooled: Shared orderbook across ~10 chains means aggregated liquidity. Supported by pro market makers, Orderly had ~$19M TVL across vaults and approaching $100B cum. volume. Major pairs (BTC, ETH) extremely liquid; can absorb large orders with minimal slippage. Smaller pairs benefit from network-wide exposure. | Deep: dYdX has historically high liquidity on its orderbook (it was the leader in volume for a while). Single ecosystem liquidity (now on its app-chain). Major coins like BTC/ETH have large orderbooks; many active market makers. Liquidity is strong, but confined to that one network (not cross-chain). | Deep: Hyperliquid saw a meteoric rise, at one point capturing ~65% of DEX perps market with record volumes (e.g. $21B daily). That indicates extremely deep liquidity and activity. It operates on its own chain; liquidity centralized there, but bolstered by its speed attracting big traders. | Decent but fragmented: GMX liquidity comes from the GLP pool on each chain (Arbitrum ~>$500M liquidity at peaks). Top assets have good depth for moderate trade sizes, but very large orders can move the price or incur slippage (especially if the pool asset mix is off). Cross-chain liquidity isn’t shared – Arbitrum and Avalanche pools are separate. In volatile times, liquidity can thin out if GLP providers pull back. |

| Leverage | High (configurable): Up to 50× leverage on certain platforms using Orderly. (WOOFi Pro offers 20×, Primex went to 50× for some pairs). Flexible margin (cross/isolated) allows high leverage if desired. Most traders stick lower for safety, but the headroom is there. | High-ish: Up to 20× on most markets (that was the limit on v3; v4 likely similar). dYdX focused on responsible leverage, so they didn’t go as high as some competitors. 20× is plenty for most, though. Cross-margin available to increase effective leverage across positions. | High: Hyperliquid also offers around 20× leverage (comparable to dYdX). They might adjust per asset, but generally they compete on speed more than on super-high leverage. Solid for most trading, but not max degen mode. | High: Up to 50× on major assets (e.g. BTC, ETH on Arbitrum). GMX started with 30× max, later increased to 50× for some. However, practical leverage can be limited by pool size and open interest caps. Still, one can get pretty high leverage, though small cap assets often have lower max. Note: very high leverage on GMX can be risky due to oracle price update frequency (you might get liquidated if price moves between oracle updates). |

| Network Speed | Fast: Sub-second order confirmations. Uses an OP-stack L2 for finality (1-2s), with off-chain matching in milliseconds. Feels instant to users – no waiting for block confirmations on each trade. Handles high throughput (matching engine can process thousands of ops/sec). In short, CEX-like responsiveness. | Fast: Also sub-second user experience. On dYdX (Starkware or new chain), orders execute quickly off-chain and settle on-chain quickly. The new Cosmos chain boasts 2,000+ TPS capability, so no performance issues. Network latency is low; however, being a global network, some minor geo-latency might exist (if you’re far from validators). Overall very responsive. | Ultra-Fast: Hyperliquid emphasizes minimal latency. Claims ~20ms matching and 1-2 second finality. Probably the fastest in terms of pure matching speed – they designed their own chain for it. Essentially real-time updates, which even high-frequency traders appreciate. The average user won’t notice a difference between 20ms and 200ms, but hyperliquid wins bragging rights on speed. | Moderate: Trades depend on blockchain confirmation (Arbitrum ~1-2s, Avalanche ~1s). No separate off-chain engine – you submit a transaction and wait ~1 block. Usually a couple seconds for feedback, which is slower than off-chain matching but still not bad. During congestion, Arbitrum could be slightly delayed. For most, it’s fine, but you might feel a tiny delay versus instant feedback on an orderbook exchange. |

Comparison Highlights: Orderly stands out by combining many of the best aspects of dYdX/Hyperliquid (speed, pro features) with a multi-chain twist that they don’t have. dYdX is a close match in functionality and has a longer track record, but is limited to its own chain’s ecosystem. Hyperliquid is like the speed demon in its own playground, great tech but again a separate island. GMX is a different animal (AMM-based, simpler interface), which shines for simplicity and its earn-yield tokenomics, but falls behind in advanced trading features and maybe in raw performance metrics for active trading.

If you’re an active trader who loves advanced orders and low fees, you’ll likely gravitate toward Orderly, dYdX, or Hyperliquid. If you prefer a simple “set it and forget it” platform and earning yield while not trading, GMX might still call to you. But as of 2025, Orderly Network offers one of the most comprehensive and fast trading experiences in DeFi, now truly giving these competitors a run for their money. It even plays nice with them – nothing stops you from arbitraging between them!

Conclusion

Orderly Network has come a long way in a short time, evolving into a formidable decentralized trading platform by 2025. It’s not just another DEX; it’s more like an entire trading infrastructure that many DEXs can leverage. By focusing on an orderbook model, Orderly has brought the familiar (and powerful) centralized exchange experience into the DeFi realm without sacrificing self-custody. For traders, that means you can finally do things on-chain that were once the exclusive domain of centralized platforms – like set complex order types, get ultra-fast trade execution, and tap deep liquidity for large orders – all while holding your own keys and hopping across multiple chains.

So, is Orderly Network a good choice for traders in 2025? For many, yes, absolutely. If you are an intermediate to advanced trader who craves more control and features than basic swap DEXs provide, Orderly will feel like a breath of fresh air (or maybe a return to something comfortable). The casual DeFi user who just wants to swap tokens might not care about orderbooks, but anyone looking to trade perps, hedge, or get a bit more sophisticated will appreciate what Orderly offers. It’s essentially built for the power-user trader demographic in DeFi that was underserved for a while.

The omnichain liquidity aspect also future-proofs Orderly – you’re not betting on a single chain’s success. Whether the action flows to Arbitrum, Base, Solana, or some new L2, Orderly can integrate it and bring the liquidity along. This makes it a safer bet that the platform will remain relevant in the shifting sands of crypto. It’s also great for users who don’t want to bounce between a dozen different DEX accounts – you get a one-stop shop (via whichever frontend you like) to trade assets from multiple networks. In a sense, Orderly is turning fragmented markets into one unified market.

Are there any downsides? Being bleeding-edge, Orderly is still growing its network of integrated front-ends. In 2025, you have a handful of choices (WOOFi Pro, perhaps some others like Spin, Primex, etc.) to access it, but it’s not as ubiquitous as Uniswap… yet. Also, using an orderbook DEX can be a bit more complex for newbies than a simple swap – the UI might show order books, depth charts, etc., which could overwhelm a first-timer. However, most intermediate traders will be fine, and the interfaces are quite user-friendly (often leveraging TradingView charts and intuitive designs). Another consideration: while you eliminate exchange custodial risk, you still have to trust Orderly’s smart contracts and tech. They’ve been audited and thus far secure, but exploits are always a possibility in DeFi. One could argue, however, that spreading across chains and using an L2 might actually reduce some risks (no single point of failure like a monolithic chain congestion or exploit).

Overall, Orderly Network in 2025 looks like a win for traders who want the best of both worlds – the speed and sophistication of centralized trading and the transparency and security of decentralized finance. It’s particularly attractive if you plan to actively trade perps and want to do so without entrusting your funds to a centralized exchange (and without paying through the nose on slippage or gas). The casual humorous take? Orderly Network is kind of like the crypto trading equivalent of a hybrid car: you get the power when you need it, efficiency when you want it, and you might feel a tad smug using it because hey, it’s the future! It brings order to the chaotic multichain universe, and for that, it’s earned a solid nod of approval from this reviewer. In the ongoing saga of DeFi vs CeFi, Orderly is evidence that DeFi is leveling up its game, and doing so in style.

TL;DR: Orderly Network delivers on its promises – it’s fast, liquid, feature-rich, and actually fun to trade on. If you’re in 2025 looking for a place to trade crypto like a pro (without signing your soul to an exchange), give Orderly a whirl. Just don’t blame us if you get addicted to setting fancy orders and start dreaming in candlestick charts – that’s on you.

FAQs

Q: What chains can I use with Orderly Network? A: Orderly is omnichain – it supports multiple blockchains. You can trade on Orderly via several networks, including popular ones like Ethereum layer-2s (Arbitrum, Optimism, Base), Solana, Polygon, and others. Essentially, if a DEX frontend on that chain integrates Orderly, you can access the shared liquidity. Orderly’s design connects these chains on the backend, so you might deposit funds on, say, Arbitrum and trade assets that someone else might be trading from Solana, all through the unified orderbook. The list of supported chains is growing – Orderly’s goal is to be chain-agnostic. Check Orderly’s docs or the specific platform you’re using (e.g., WOOFi Pro, etc.) to see which chains are currently live. In 2025, the major EVM chains and even some non-EVM (Solana, Sei) are in the mix.

Q: Do I need to hold $ORDER token to use Orderly Network? A: No, you don’t need to hold or use the $ORDER token for basic trading on Orderly. You can deposit USDC (or other supported collateral) and trade without ever touching $ORDER. The $ORDER token mainly comes into play for staking and rewards. If you do hold $ORDER, staking it can give you benefits like earning a share of trading fee revenue in USDC, boosting your trading reward tier, and giving you governance voting power. But these are optional perks. The actual trading experience (placing orders, etc.) uses stablecoins or crypto as margin, not the $ORDER token itself. In short, $ORDER is like a loyalty/membership token – nice to have for power users, but not required to just trade.

Q: How do I start trading on Orderly Network? A: To trade on Orderly, you actually use one of the partner platforms or interfaces built on Orderly. Think of Orderly as the engine under the hood; you still need a car to drive. Platforms like WOOFi Pro, Spin, LogX, Primex, and others provide user-friendly UIs that connect to Orderly’s liquidity. So, the steps:

- Pick a platform that uses Orderly (for example, WOOFi Pro on Arbitrum, or Orderly’s own reference interface if available).

- Connect your wallet (make sure it’s the right chain that the platform is on – e.g., for WOOFi Pro use MetaMask on Arbitrum, for a Solana app use Phantom on Solana, etc.).

- Deposit funds into the Orderly smart contract vault via that interface. Usually, you’ll deposit a stablecoin like USDC as collateral. This will be one on-chain transaction to move funds into Orderly’s custody (smart contract).

- Once deposited, navigate to the trading page for the perps/spot market you want. You’ll see the orderbook, charts, etc.

- Place orders as you would on any exchange (choose limit/market, set size, price, etc., and confirm). No blockchain transaction is needed for each order – the order goes to Orderly’s matching engine instantly.

- When you’re done trading, you can withdraw funds from the vault back to your wallet (that will be another on-chain transaction).

It sounds like a lot of steps, but it’s pretty straightforward in practice – it feels like using a normal exchange interface. The initial deposit and final withdrawal are the only blockchain transactions; everything in between is off-chain magic. If you ever used a centralized exchange, it’s similar: deposit, trade, withdraw. Except here, the “exchange” is decentralized and you use your own wallet at all times (no account signup or KYC needed – hooray!).

Q: Is Orderly Network safe and audited? A: Orderly Network has been audited by reputable security firms (like Zellic) and is built with security in mind (remember, it’s handling multi-chain assets, so they know security is paramount). Being non-custodial, you hold assets in smart contracts – so the safety depends on those contracts being secure and the protocol functioning honestly. Thus far, Orderly has operated without major security issues reported. They also have mechanisms like an insurance fund perhaps, and their code is out there for scrutiny. That said, smart contract risk is never zero. Orderly’s contracts (for the vaults, etc.) are somewhat complex because of cross-chain functionality. So, while audited, one should never treat any DeFi platform as 100% risk-free. It’s a good sign that professional auditors gave it a thumbs up, though. Also, Orderly’s approach of on-chain settlement means everything is transparent – you can observe balances in the vaults and trade records on the settlement chain, which adds a layer of trust (it’s hard for anything shady to go on without people noticing on-chain). In summary, Orderly appears safe by DeFi standards and has taken precautions, but always exercise normal caution: don’t put all your life savings in one DeFi protocol, and stay informed about any updates or known issues. Thus far, Orderly’s name has been… well, orderly with no messy incidents.

Q: How does Orderly Network differ from an AMM like Uniswap? A: Orderly Network uses an orderbook model, whereas Uniswap and other AMMs use automated liquidity pools. The experience and mechanics are quite different:

- On Orderly, you see bids and asks and you either take an existing order or place one and wait for it to be filled. On Uniswap, you just swap directly against a pool’s liquidity using a formula (no concept of an orderbook or waiting – it’s an instant swap but with potential slippage).

- Orderly can offer advanced order types (stop-loss, limit orders, etc.), whereas Uniswap is essentially always a market order against the pool at whatever the current price is.

- In terms of price impact, Orderly’s slippage depends on orderbook depth – sometimes that means less slippage if the book is deep. Uniswap’s slippage depends on pool size and your trade size relative to it. For large trades, Orderly’s unified liquidity could give a much better price. For very small trades, both are usually fine, though Uniswap you pay a fixed LP fee (like 0.3%) whereas Orderly you might pay, say, 0.05% fee but possibly a tiny bit of slippage (or none if you use a limit order).

- Orderly also supports derivatives (perpetual futures with leverage). Uniswap is typically just spot swaps (though there are now some on-chain perps AMMs, but Uniswap itself isn’t for perps). So, Orderly is more feature-rich for traders, while Uniswap is super simple and great for quick token-to-token swaps.

- One isn’t strictly “better” than the other; they serve different audiences. If you want simplicity and access to tons of long-tail tokens, AMMs like Uniswap are great. If you want a trading experience with more control, better price execution for size, and derivative markets, Orderly shines. In short, Orderly = decentralized orderbook exchange (like a decentralized Binance), Uniswap = automated swap (like a vending machine of liquidity). Many users actually use both depending on their needs.

Q: What markets can I trade on Orderly? A: Orderly supports a variety of markets, especially perpetual futures markets for major cryptocurrencies (BTC, ETH, SOL, etc., against USDC) and some altcoins. At the time of writing, there are dozens of perp markets – essentially, if there’s demand and a partner front-end wants it, a market can be listed (it’s permissionless to list new markets on Orderly). They had ~98 markets by 2025 including big ones and even quirky ones like meme coin perps. Some Orderly frontends might also offer spot trading for certain pairs, but the flagship product is perps. You can check an Orderly explorer or the interface you’re using to see the list. It’s growing over time. Notably, Orderly can list things that might not be on other exchanges yet, because any project can leverage its orderbook – we saw example of TRUMP perps being listed permissionlessly and drawing volume. So, expect all the top coins, plus a rotating cast of other popular assets in perp form. Leverage is typically available on all perps. If you’re looking for something super obscure, it might or might not be there depending on if someone seeded a market for it. But given the ease of listing, Orderly might surprise you with offerings beyond the usual BTC/ETH. Always make sure to understand the asset you trade (especially if it’s a meme coin perp with wild volatility).