TL;DR (Summary)

-

- Perpetual futures (“perps”) are cryptocurrency derivatives with no expiration date that have revolutionized crypto trading.

- Unlike traditional futures that expire on specific dates, perps can be held indefinitely and use a funding rate mechanism to keep their price aligned with the spot market.

- These instruments have dramatically increased market liquidity, improved price discovery, and become the dominant trading venue in crypto with volumes often exceeding spot markets.

- While perps offer advantages like leverage and continuous trading, they can also amplify market volatility during crashes and create cascading liquidations.

- The future of perps includes growth in decentralized platforms and potential regulatory challenges as authorities grapple with their high-risk, high-reward nature.

What the Heck Are Perpetual Futures? (Perps 101)

Imagine a futures contract that never expires – kind of like the Hotel California of trading: you can check out any time you like, but your contract never leaves. Welcome to the world of perpetual futures (or “perps” for short), one of crypto’s wildest inventions. Perps have taken crypto markets by storm, shaking up liquidity and price discovery in ways that make traditional finance sit up and take notice. In this article, we’ll break down how these eternal futures work, how they turbocharge liquidity, and how they influence prices – for better or worse. We’ll also peek at funding rates (the secret sauce keeping perps in line), revisit a few rollercoaster market events, and touch on emerging trends (hello, decentralized perps!) and regulatory vibes. Grab your popcorn (and maybe a stress ball), and let’s dive in – with a wink and a nod along the way.

Perpetual futures are futures contracts with no expiration date – yes, you read that right. Unlike a traditional futures contract that settles on, say, the last Friday of the month, a perp can theoretically run forever. Traders can hold a position indefinitely (until they choose to close it or… get liquidated 🤕). This means no frantic rolling over of contracts each quarter and no expiry-day drama. As one academic paper put it, “perpetual futures contracts offer the same characteristics as traditional futures but without an expiration date”. The idea was pioneered by crypto exchanges (BitMEX famously introduced perps around 2016), and it caught on like wildfire in the 24/7 crypto markets that never sleep.

So how can a futures contract last forever and still track prices without a settlement date? Enter the funding rate – the magic glue that binds the perp price to the underlying spot price. Funding rates are small periodic payments between long and short traders, typically charged every 8 hours (though some platforms do it hourly). If the perp price is trading above the spot price, the funding rate is usually positive – meaning longs pay shorts a fee. This incentivizes longs to chill out (because paying to hold a long gets old fast) and encourages more shorts to enter (since they’re getting paid), pushing the perp price down toward spot. Conversely, if the perp is below spot, the funding rate goes negative – shorts pay longs – nudging the price back up. In essence, funding rates act like a little tug-of-war mechanism, constantly re-centering the perp price around the actual market price of the coin. It’s a clever trick that keeps perps tethered to reality without the need for an expiry date.

Aside from the lack of expiration and the funding rate mechanism, perps behave a lot like normal futures. You can go long (bet price will rise) or short (bet it falls). They’re typically margined and settled in cryptocurrency or stablecoins, and they allow leverage – often very high leverage (crypto exchanges aren’t shy, offering 5x, 10x, even 100x leverage in some cases). This means you can control a large position with a small amount of collateral – a recipe for high risk and high reward. Perps essentially blend the flexibility of spot trading (no expiry, trade anytime) with the leverage of futures. As one blog quipped, “imagine a financial instrument that blends the flexibility of spot trading with the leverage of futures, but without the constraints of an expiry date… That’s what perpetual futures offer”. It’s like futures on steroids and caffeine – continuous action, 24/7. No wonder they’ve become incredibly popular among crypto traders.

To put their popularity in perspective, by the end of 2022 perpetuals were trading over $100 billion every single day on crypto exchanges. Yes, billions with a B – daily. In fact, perps have grown to outshine their underlying spot markets: it’s common for the trading volume in a crypto’s perp contract to exceed the volume in the actual coin’s spot market. (That’s right, sometimes more people are trading ghost futures of Bitcoin than actual Bitcoins – welcome to crypto 😜.) One research piece noted that since 2020, cumulative volume in crypto perp markets blew past $60 trillion, matching the total volume of all stock markets in the world in 2019! Let that sink in: a handful of crypto exchanges churning out futures on internet money rival the trading volume of every stock exchange on Earth. Perps aren’t a sideshow – they’ve become the main stage.

Key differences vs. traditional futures: To recap in plain English (in case you need to explain this at the dinner table and want to sound smart), here are the big differences between perps and those boring old-school futures your grandpa traded:

- No Expiry Date: Traditional futures expire on a set date (e.g., every quarter), so you eventually have to settle up or roll over your position. Perps? They never expire – you can hold forever (or until your account balance says “nope”). This is hugely convenient for traders; no annoying contract rollover, no expiry arbitrage games. It’s one perpetual party – hence the name.

- Funding Rate: Because there’s no expiry to force convergence with the spot price, perps use the funding rate mechanism to stay anchored. As explained, traders periodically pay or receive a fee depending on the price gap between the perp and the spot market. Traditional futures don’t need this; they naturally converge to spot at expiry. But perps have this quirky interest-rate-like feature to mimic that convergence continuously. Think of it as a little heartbeat every 8 hours that keeps prices in check.

- High Leverage & 24/7 Trading: Perps are typically found on crypto exchanges that run 24/7 globally, and they often allow much higher leverage than regulated futures markets. Want to trade Bitcoin at 3 AM on Sunday with 50x leverage? With perps, no problem (just don’t expect your risk manager to approve 😅). Traditional futures usually have set trading hours (though some electronic markets are near 24/7) and often lower leverage for retail traders (plus regulatory safeguards). Crypto perps are the Wild West in comparison.

- Settlement in Crypto: Many crypto perps settle in crypto or stablecoins (for example, you post margin in USDT and your P&L is in USDT, or on some early platforms like BitMEX you posted in Bitcoin and won/lost more Bitcoin). There’s no delivery of an underlying asset – it’s all cash-settled (or shall we say “crypto-settled”). Traditional commodity futures might settle in physical goods or cash at expiry; perps just keep going with periodic funding settlements.

Now that we know what perps are and how they tick, let’s explore their impact on the market – starting with liquidity, the lifeblood of any trading market.

Liquidity: Perps Turn It Up to 11 📈

One of the biggest impacts of perpetual futures has been on market liquidity. Liquidity refers to how easy it is to trade an asset quickly, in large amounts, without causing a big price movement. A liquid market is like a deep pool – you can dive in or cannonball out without making waves. An illiquid market is like a kiddie pool – even a small splash can slosh water everywhere (i.e., move the price). Perps have essentially dug Olympic-sized swimming pools in the crypto market.

As mentioned, the trading volumes on perpetual futures are enormous – often eclipsing spot markets for the same coins. All that activity means tighter spreads and deeper order books (in non-geek speak: more buyers and sellers at any given price), which makes it easier for anyone to enter or exit positions. One crypto platform noted that “the market for perpetual futures tends to offer greater liquidity, meaning you can quickly enter or exit positions without causing significant price fluctuations.” In other words, you can trade big size on perps with less slippage. For traders (especially big ones), that’s gold. High liquidity begets even more trading, in a virtuous cycle – people gravitate to where they know they can get in and out easily.

Why do perps attract so much liquidity? A few reasons:

- Single, Continuous Market: With traditional futures, liquidity can get split across multiple expiry dates (March futures, June futures, etc.). Perps concentrate all interest in one unified market per asset. Everyone’s trading the same perpetual contract rather than a dozen different delivery months. This focus “fosters a higher liquidity which in turn facilitates price discovery”. It’s like having one huge party instead of several smaller ones in different rooms – all the traders meet in one place.

- Lower Fees and Fast Execution: Many exchanges offer lower fees on futures trades than on spot trades, and because it’s all off-chain, execution is lightning-fast with no blockchain confirmation wait. Traders love saving on fees (who doesn’t?) and being able to trade instantly. If you’re arbitraging or doing high-frequency strategies, perps are often the venue of choice.

- Leverage and Shorting: Perps let traders use leverage and go short easily, which attracts a lot of speculative and hedging activity that might not occur on the spot market. A spot Bitcoin trade requires full cash outlay to buy 1 BTC; a perp trade might only require a 10% margin. That means traders can take bigger positions with the same capital – juicing volumes. Also, the ability to short via perps brings in participants betting on price drops or hedging holdings. More players = more liquidity. In contrast, shorting on spot can be harder (you’d have to borrow the asset), so perps open the door for that side of the market.

- Around-the-Clock Trading: Crypto never sleeps, and perps are traded worldwide on exchanges that are open 24/7. This continuous availability draws in global liquidity. Even when New York traders go to bed, someone in London or Singapore is trading perps. Traditional markets with closing times can see liquidity dry up after hours; perps don’t have that issue.

The net effect is that perps have dramatically increased the liquidity of crypto markets. They’ve effectively bridged gaps between different exchanges and regions too – arbitragers trading perps ensure prices (and liquidity) don’t fragment too much. In fact, when China cracked down on crypto in 2021, one of the largest exchanges (Huobi) had to suspend its perp trading for Chinese users. Researchers observed that when perps were suddenly removed, the underlying spot markets became less liquid – a natural experiment showing how much perps had been propping up liquidity.

Greater liquidity usually means a more efficient market – which brings us to price discovery.

Price Discovery: When the Tail Wags the Dog 🐶📈

Price discovery is the process by which markets set the “correct” price of an asset based on supply, demand, and information. In crypto, price discovery happens across a labyrinth of exchanges and products – spot markets, futures, options, you name it. Perpetual futures, with their massive volume and 24/7 action, have become a key venue for price discovery in crypto.

Because perps are so liquid and leveraged, they often react fastest to new information. If some big news hits (say, Elon Musk tweets something crazy about Bitcoin), you might see the perp markets on Binance, Bybit, etc., move instantly as traders speculate, and then spot markets follow, kept in line by arbitrageurs. In this sense, perps can lead the price discovery dance. There’s an old saying in markets: “the futures lead the spot.” In crypto nowadays, it’s “the perps lead the spot.” These contracts have effectively become the reference price in many cases – even indexes often incorporate perp prices.

From an academic standpoint, having a single highly liquid perpetual contract helps concentrate activity and information. As noted earlier, a single active contract per asset “facilitates price discovery”. Empirical research backs this up: the introduction of perpetual futures tends to improve pricing efficiency in the underlying asset. One study concluded that *perpetual contracts increase spot market liquidity and price efficiency. In plain terms, prices become more accurate and reflect information faster once perps are in the mix – partly because arbitrage between perps and spot keeps prices aligned, and partly because more speculative trading means every piece of news or sentiment gets quickly priced in.

However, (and there’s always a “however” in crypto), perps can also distort price signals in the short term and introduce some shenanigans. Because they allow high leverage, sometimes the “tail wags the dog”: heavy trading on perps can push the price away from the true spot value, at least briefly, especially if the market gets one-sided. For example, if a ton of traders ape into long positions on Bitcoin perps with 50x leverage (perhaps hyped by a tweet or just FOMO), the perp price might shoot above the spot price. In theory, arbitrageurs will short the perp and buy spot to profit, which brings them back together – and the funding rate will make those longs pay through the nose to hold their bet, eventually damping their enthusiasm. Usually, this feedback works and the gap closes fast.

But during periods of extreme optimism or pessimism, these gaps (called basis or premium/discount) can grow and persist for a bit. Funding rates go wild (more on that soon) and can themselves become part of the story of price movement. Moreover, when the crowd is very lopsided (too many longs or shorts), it sets the stage for dramatic reversals: liquidation cascades or short squeezes that yank the price violently. In this way, perps can amplify volatility – price discovery overshoots and then snaps back.

A vivid example: In April 2021, as Bitcoin raced to new highs, funding rates on perps were consistently positive and elevated (a sign everyone and their grandma was leveraged long and paying to stay in the trade). The perp price kept a hefty premium over spot. This indicated a risk: if something spooked the market, all those over-leveraged longs could unwind in a hurry. Sure enough, May 2021 brought a nasty correction (triggered by a mix of regulatory news and Tesla’s about-face on Bitcoin). The unwinding of bullish perp positions shook the market violently, as we’ll detail in a bit – billions in longs got liquidated, sending the price down further than it might have gone otherwise. So while perps aid price discovery, they can also exacerbate price swings when the herd stampedes in one direction. It’s the double-edged sword of added leverage and liquidity: normally it smooths things out, but in extreme moments it can slice you pretty deep.

On balance, though, most agree that perps have improved the efficiency of crypto pricing. Arbitrage between perps, spot, and even dated futures (like CME futures) keeps the markets tied together. Prices across exchanges are less fragmented because big traders will arbitrage any differences. Perps contribute significant information – for instance, the funding rate is often seen as a sentiment indicator (positive funding = bullish bias, negative = bearish bias) which gives insight into market expectations that spot doesn’t provide. And as Cornell researchers found, perps seem to have reduced the frequency of pump-and-dump schemes in crypto; it’s harder to manipulate a highly liquid perp market than a thin spot market. (Of course, if a pump does happen, the added leverage can make the dump uglier – perps “make pump-and-dump events less likely to happen; but when they do happen, perpetuals amplify the damage.” Imagine a bouncy castle: harder to tip over, but once it tips, everyone bounces harder.)

In short, perps have become integral to finding the “right” price for crypto assets each minute. They are where a huge chunk of price discovery occurs, though not without some quirky dynamics. Next, let’s zero in on that little engine of perp markets we keep mentioning: funding rates, and how they influence stability and price moves.

The Funding Rate: Tiny Fee, Big Influence 💸

If perpetual futures are the engine, the funding rate is the governor that keeps that engine from running off the rails. It’s a simple concept with significant effects on market behavior. We touched on the basics: when the perp price > spot price, longs pay shorts; when perp < spot, shorts pay longs, usually every 8 hours. The fee is usually a small percentage (it can be 0.01% or 0.1% of the position, etc., depending on how large the price gap is). That might sound negligible, but annualized it can be huge, and during wild market moves the funding payment can add up quickly.

Market stability: The primary role of the funding rate is to ensure the perp price doesn’t drift too far from spot – it’s like a gravitational pull keeping two planets (perp and spot) orbiting closely. This definitely contributes to market stability in a general sense. Without funding, a perpetual contract could trade vastly above or below the actual asset value for prolonged periods, which would be chaotic and invite massive arbitrage crises. The funding mechanism “aims to ensure the perpetual contract price remains aligned with the spot price, balancing the market by adjusting the cost of holding positions”. In normal times, this works smoothly: any slight premium or discount gets corrected by traders positioning for those funding payments.

However, funding rates themselves can become a barometer of market sentiment and a driver of behavior. A high positive funding rate means longs are paying a lot to shorts. This only happens when there’s a strong bullish conviction – so much that longs are desperate to stay in position and are willing to pay a premium. It reflects euphoria or greed in the market. But it also raises the cost of those long positions, which can dampen further buying or prompt some longs to close if they think twice about the fees. On the flip side, it attracts arbitrage shorts who are happy to collect those hefty funding payments (these arbitrageurs will short the perp and go long on spot to hedge, locking in the funding as profit). Those arbitrage actions tend to increase supply on the perp (pushing its price down) and increase demand on spot (pushing that up), restoring equilibrium. So, in a self-correcting way, extremely high funding should curtail an overheated rally eventually.

The same logic applies to high negative funding: it signals extreme bearish sentiment (lots of shorts dominating) and can precede a rebound as the cost of holding shorts grows and value buyers step in to take the opposite side. In practice, traders watch funding rates closely as an indicator. As one analysis noted, “persistent high or low rates can indicate over-leveraged markets or potential price corrections”. A very high funding rate is often a warning sign: the long side is crowded and if price even blinks downwards, those longs might start to close or get liquidated, sending price down more – the makings of a reversal. Similarly, very negative funding can hint that perhaps everyone is too bearish, and if a positive catalyst comes, shorts will scramble to cover.

A classic pattern: during bull runs, funding rates often turn positive and stay that way – longs keep paying, effectively an ongoing bull tax. During downtrends, funding can stay negative – shorts paying to maintain their positions. In choppy markets, funding oscillates around zero. Some traders even use funding rate as a contrarian indicator: e.g., if funding is insanely high, they caution that the top might be near (too much greed), and if funding is deeply negative, perhaps a bottom is brewing (too much fear).

Now, about market stability: When funding rates spike or flip rapidly, it can cause short-term instability because it’s usually coinciding with a momentum swing. For instance, imagine Bitcoin’s price starts dropping quickly – the perp might go from slightly positive funding to deeply negative after a big flush, as shorts pile on and longs get wiped. That rapid change can actually accelerate the move: once funding goes negative, new longs are now getting paid to buy, which might entice dip buyers, helping to form a bottom. In contrast, if a price pumps and funding shoots up, new shorts start getting paid to jump in, which can help cap the blow-off top. In this way, funding rates act as a stabilizer by beckoning contrarians – but only if the market participants respond to those incentives.

However, in extreme moments, funding can’t save you: if nobody is willing to take the other side, the price will move hard until someone does. There have been times when exchanges had to cap the funding rate because it went so high (or low) – basically saying, “OK, longs, you can’t pay more than X% per interval no matter what.” That happened during some 2020–2021 crazy moves. So funding has its limits as a stability mechanism; it’s not a circuit-breaker, just a nudge.

One could say funding rates help prevent prolonged dislocations between futures and spot, thereby keeping the overall market more stable. Without funding, we might see weird scenarios where a perpetual futures price is way out of sync, which could cause huge unpredictable corrections when it eventually snaps back. With funding, those gaps are regularly trimmed. Traders certainly appreciate that perps usually trade very close to spot – it makes them comfortable using perps as proxy for the real thing.

To sum up, funding rates influence market behavior in several ways:

- Aligning Prices: They keep perp and spot prices glued together most of the time, which generally stabilizes the market and makes pricing more consistent across venues.

- Signaling Sentiment: The level of the funding rate is like a thermometer for market sentiment. “A high positive rate signals bullish sentiment… a high negative rate indicates bearish sentiment.” Traders watch this to gauge if there’s an imbalance.

- Incentivizing Moves: They create incentives that can either reinforce a trend or push against it. If you’re long and paying high funding, you might think twice about holding – which could slow a rally. If you’re short and see negative funding (meaning you receive money), you might stay short longer – which could add pressure in a downtrend. Conversely, a contrarian might take the opposite side to collect those payments, which can reverse a move. It’s a cat-and-mouse dynamic.

- Risk of Cascades: If funding is extreme, it means leverage is extreme on one side – the market is like a loaded spring. Any sharp price move against the crowded side can trigger a cascade of liquidations (because all those leveraged folks get margin-called), leading to a sudden unstable price swing. So ironically, while funding tries to keep things orderly, the very conditions that cause extreme funding (crowded trades) can sow instability if the crowd stampedes out together.

In practice, many veteran traders respect the funding rate the way sailors respect the tide: ignore it at your peril. It can eat your lunch via fees if you’re on the wrong side for too long, and it can give you hints about when the winds might change.

Speaking of winds changing, let’s look at real-world examples where perps and funding played a starring role – those dramatic market events that make it into crypto lore.

When Perps Rule the Day: Notable Market Events 🎢

Crypto history is peppered with days when perpetual futures markets basically decided the fate of prices. Let’s revisit a few such thrill rides and see how perps influenced liquidity and price discovery in each:

1. Black Thursday (March 12, 2020): This was the day HODLers still whisper about around the digital campfire. Bitcoin’s price crashed almost 50% in 24 hours, with a particularly harrowing drop in a 15-minute window. What happened? A global panic (thanks, pandemic) hit all markets, and in crypto it triggered a cascade of long position liquidations on BitMEX, the leading perp exchange at the time. As prices fell, more leveraged longs got wiped out, and their forced sell orders pushed the price down further, liquidating even more longs – a vicious feedback loop. Bitcoin plunged from around $7,200 to as low as $3,700 in a blink. In just 15 minutes, BTC fell to a 10-month low of $5,678, forcing $702 million of liquidations on BitMEX – the most in over a year. It was like a dam breaking.

Liquidity on the way down evaporated; the order books were thin because who wants to catch a falling knife, right? This is a key point: perps usually add liquidity, but in a fast crash, market makers can pull back, and then the perps amplify the illiquidity because the liquidation engine is dumping positions automatically into an empty order book. BitMEX even went offline for 25 minutes (they claimed engine issues) during the mayhem, which many suspect prevented an even deeper crash. In fact, as soon as BitMEX halted, Bitcoin’s price bounced from $3,700 back above $5,000 – basically “rallying without the gigantic sell wall of the BitMEX liq[uidations]” as one prominent trader noted. This event showed both the power and peril of perps: liquidity was great until it suddenly wasn’t, and then perps drove the price into the ground. Once the perp machine was briefly unplugged (thanks to that “hardware issue” or maybe a deus ex machina), the price recovery was swift – almost as if the perps were the problem. After this carnage, a lot of traders reassessed just how levered they wanted to be. It also shook trust in BitMEX, which soon after lost its crown to other exchanges.

Humor aside, “Black Thursday” is a stark example of perps dominating price discovery in a crash – they discovered a very ugly price, one might say. But it also highlighted how liquidity can vanish when everyone is on the same side of a leveraged boat. It’s like the quote: “Only when the tide goes out do you discover who’s been swimming naked.” On March 12, 2020, a lot of traders were caught naked and the perp tide went way, way out.

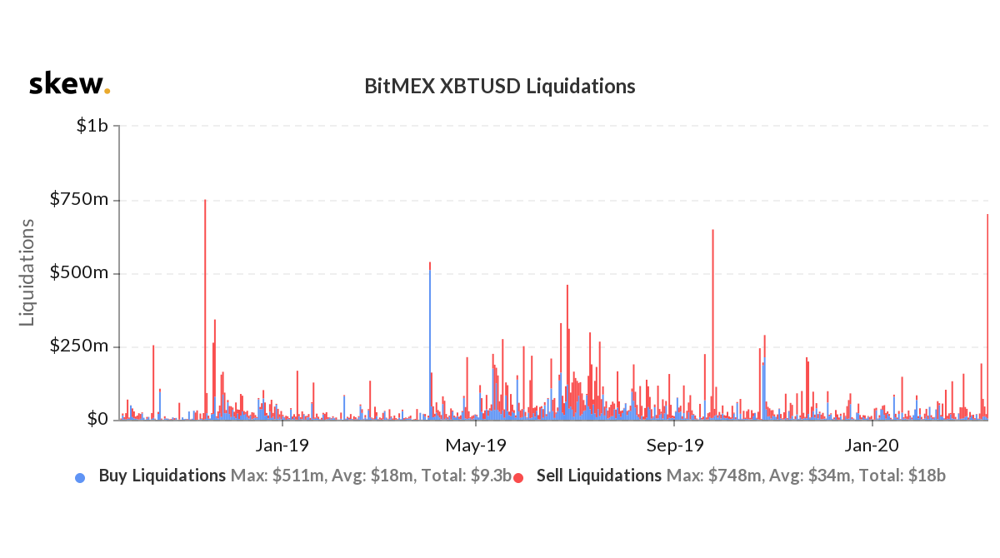

Chart: BitMEX Bitcoin perpetual futures liquidations (blue=short liquidations, red=long liquidations) prior to March 2020. Notice the huge spikes – these indicate cascade events where hundreds of millions of dollars of positions were force-closed. In March 2020 (off the chart to the right), an even larger spike occurred, with over $700M in longs liquidated within hours. Such events show how perp markets can suddenly suffer a liquidity crunch, leading to massive price moves.

2. The May 19, 2021 Crash: Fast forward a year. The scene: Bitcoin had hit an all-time high of ~$65k in April 2021 after a roaring start to the year. By mid-May, however, clouds were forming – Elon Musk was tweeting concerns about Bitcoin’s energy use, and there were whispers of regulatory crackdowns in China. The market began to tremble. Then on May 19, it capitulated in spectacular fashion. Bitcoin plunged intra-day from the mid $40ks down to about $30k (briefly even dipped below $30k on some exchanges), a 30%+ drop in one day. It was an all-out long squeeze: all the overleveraged bullish bets that had piled up during the euphoria got absolutely flushed. Over $8 billion worth of positions were liquidated across crypto derivative markets in a matter of hours. Yes, that’s billion with a B, in one day! Exchanges like Binance and BitMEX saw record liquidations; it was arguably an even larger cascade (in dollar terms) than March 2020, although as a percentage drop it was a bit less severe.

What role did perps play? A huge one. Leading up to the crash, funding rates were consistently positive, telegraphing that longs were crowded. When negative news hit and the price started slipping, it triggered margin calls on those longs. That led to automatic sell-offs (liquidations), pushing the price lower, which triggered more liquidations – you see the pattern. Liquidity was thin on the way down as market makers widened spreads or pulled quotes (they don’t like catching falling knives either – can’t blame ’em). Essentially, the perp market acted as an accelerant to the fire. Observers noted that the crash “shook out bullish leverage from cryptocurrency derivatives markets, leading to more than $8 billion in position liquidations”. In other words, the perp market needed to purge all those excessive longs, and it did so via a swift kick in the pants to the price.

After the bloodbath, guess what? Funding rates went deeply negative – so many had flipped to short or gotten net short in panic that now shorts were paying longs. That actually helped form a bottom around $30k, as some brave souls took the other side (getting paid to go long is a nice incentive when the price is already down 50%+ from its highs). The price rebounded to $37k by the end of that day, a wild swing, and over the next couple of months it stabilized and even started grinding back up. This event showed how perps can violently discover a new price floor by liquidating a ton of positions – essentially ripping the band-aid off – and then, through the flipside of funding incentives, help the market recover once the excess is cleared out.

For a casual observer, May 19, 2021, was like a horror movie (some dubbed it “Crypto’s Bloody Wednesday“). But it did demonstrate the somewhat self-correcting nature of perp markets: over-leverage built up (funding signaled it), it blew up spectacularly (price overshot downwards), and then the system stabilized (funding turned opposite, inviting equilibrium). Still, if you were on the wrong side, ouch.

3. Litecoin’s Fake News Pump (September 13, 2021): Not all perp dramas are market-wide crashes. Some are quick pumps and dumps aided by leverage. A fun (unless you traded it) episode was when a fake press release claimed Walmart would start accepting Litecoin (LTC). Litecoin’s price exploded nearly +30% in minutes on that false news. Perp traders, smelling opportunity (or just FOMOing), piled in. Liquidity on LTC perps spiked as speculators bought the rumor. But within an hour, Walmart confirmed the news was bogus, and Litecoin came crashing back down to earth, giving up the entire gain.

Perpetual futures likely amplified this whipsaw. Why? Because with leverage, people could bet big on the news, and when it reversed, they had to unwind those bets just as fast. The perp exchanges probably saw a surge of liquidations for anyone who bought late and on margin. The funding rate on LTC perps likely went nuts for that brief period as the price diverged from spot (until spot caught up then reversed). The whole thing was over so quickly that the 8-hour funding windows might not fully reflect it, but market makers and savvy traders definitely arbitraged the heck out of it.

Researchers pointed out that in cases like this, perps can amplify the damage of a false pump. The LTC incident was exactly that: a rapid pump-and-dump where perps added fuel. On the bright side, the existence of a large perp market on LTC may have also meant the spike was brief – arbitrageurs and short sellers (including those on perps) pounced on the mispricing quickly, helping price discovery bring LTC back to reality within hours. In a less developed market, such a fake news might have kept the price elevated for longer. So you could argue perps both pumped it faster and dumped it faster, essentially compressing the whole saga into a short time frame. Blink and you missed it, but it was a wild ride for those watching the charts that morning!

4. Other Squeezes and Cascades: We’ve highlighted a couple of crashes, but perps are also responsible for epic short squeezes. For example, in late July 2021, after months of negativity, Bitcoin’s price jumped from ~$30k back to ~$40k in a week, partly fueled by shorts getting squeezed out. Funding had been negative for a while (everyone bearish), and when a bit of bullish news hit (rumors of Amazon getting into crypto, etc.), the price uptick forced shorts to cover, which rocketed the price higher, which forced more shorts to cover – the classic popcorn effect.

Perps were the battleground for that: as the perpetual futures price started running up, it dragged spot along. Open interest (the total number of perp contracts) dropped as shorts closed out, meaning a lot of money that was betting on further downside had to wave the white flag. The result: a swift 30% price jump in days. The perp funding flipped from negative to positive in that period, showing how sentiment can turn on a dime – and how perps leading the charge can cause a feedback loop.

We also saw crazy action in early 2021 when GameStop-esque short squeezes hit some altcoins via perp markets. On some smaller exchange perps, clever traders noticed many participants were short and paying high funding, so they orchestrated short squeezes – pumping the price, liquidating the shorts, and profiting from the chaos. If you ever see an altcoin suddenly go +100% in an hour for no reason, odds are something funky in the perp market (low liquidity + high leverage) was at play.

All in all, perpetual futures often sit at the heart of crypto’s most dramatic moments. They’re where leverage meets liquidity, and that combo can either stabilize markets by improving depth or destabilize them in a cascade of margin calls. It just depends on whether traders keep their heads or all run for the exits at once.

The Road Ahead: Decentralized Perps, Trends & Regulators

Emerging Trends

Perpetual futures started on centralized crypto exchanges like BitMEX, Binance, Bybit, etc., but the concept has been spreading its wings. One big trend is the rise of decentralized perp exchanges (DEXs for perps). Platforms like dYdX, GMX, Perpetual Protocol, and others have created ways to trade perps directly on blockchain, without a central intermediary.

Initially, many thought “no way can DeFi handle the volume and speed of perp trading,” but technology is improving (Layer-2 scaling, better oracles, etc.), and indeed volumes on decentralized perps have been soaring. In 2024, decentralized perp platforms saw their trading volumes grow over 200% compared to the year before, and some newer chains like Solana-based perps grew several thousand percent!

The appeal is obvious: traders can get the same perpetual action but keep custody of their funds and avoid some KYC/regulatory hurdles by using a DEX. By 2025, some projections suggest decentralized derivatives could make up 30% or more of the total crypto futures market volume. That’s a big shift if it plays out – it means the liquidity and price discovery might start migrating from big centralized venues to blockchain-based ones, further democratizing (or fragmenting?) the market. It’s like perps are having kids and those kids are moving out of the house.

Another trend is perps on non-crypto assets. Some platforms are experimenting with perpetual futures on commodities, equities, or other indices – essentially bringing the “perp” structure to traditional markets. This is nascent (and definitely a regulatory gray area), but imagine a world where you could trade a perpetual contract on gold or the S&P 500 in a crypto-like fashion 24/7. Some projects call related concepts “everlasting options” (for options with no expiry) – lots of innovation brewing. The success of crypto perps has people wondering if this model can be applied elsewhere.

We’re also seeing more sophisticated participants enter the perp markets. Hedge funds and institutions that once only dabbled in CME’s regulated Bitcoin futures are now paying attention to offshore perps because of the liquidity and arbitrage opportunities. The lines between institutional and retail volume are blurring as markets mature (though perps are still largely retail-driven).

Regulatory Considerations

Regulators have noticed the huge role of perps, and many are not thrilled. In the U.S., for example, perpetual futures are viewed as swaps in regulatory terms, which means offering them to retail customers (outside proper derivatives exchanges) is a no-no. The CFTC has explicitly said “‘perpetual futures’ can constitute swaps. A swap is a swap, even by any other name.”

This was part of actions they took against some crypto platforms. Case in point: BitMEX’s founders were charged and eventually penalized for essentially running an unregistered trading platform accessible to U.S. users. Binance, the largest exchange, also faced regulatory heat for its derivatives offerings. In response, many big exchanges have geofenced U.S. persons and stepped up KYC to avoid the ire of regulators over perps.

Europe also is eyeing crypto derivatives in their regulations (MiCA), and countries like the UK outright banned retail crypto derivatives sales in 2021, deeming them too risky for the average Joe. So in some places, if you’re a normal retail trader, you legally can’t touch perps (of course, savvy folks often find workarounds, but that’s another story).

Regulators worry about the high leverage and volatility – stories of people getting wiped out in minutes isn’t exactly a great advertisement for consumer protection. There’s also market integrity concerns: since perps are cash-settled and can be more prone to manipulation (in thin moments) compared to underlying markets, authorities want to ensure fair play.

On the flip side, some regulators see the massive volumes and are grudgingly like, “if we can’t ban it, maybe we should regulate it properly.” For instance, CME (a regulated U.S. exchange) considered launching their own perpetual futures on Bitcoin – they haven’t yet, but they did create new futures with shorter expiries and are exploring more flexible products. The industry is pushing for clarity – perhaps we’ll see regulated perps or similar instruments in traditional venues eventually, which would validate the concept further.

Meanwhile, the growth of decentralized perps poses a new challenge: how do you regulate a smart contract that anyone can interact with globally? Recent enforcement actions (like the CFTC charging a person for manipulating a DeFi exchange’s perp market) indicate regulators will go after individuals or teams behind decentralized platforms if wrongdoing occurs. But if the protocol is truly decentralized, it could be tough to control. This tug of war is likely to continue.

Risk Management

Another consideration – and something both industry and regulators emphasize – is ensuring traders actually understand the risks. Some exchanges have toned down their max leverage (Binance famously reduced max leverage for new users after 2021’s chaos, from 125x to something saner). There’s more education around funding rates, liquidations, etc.

Still, new traders see “100x” and sometimes yolo their account, only to learn a very hard lesson. The hope is that over time, the ecosystem will implement better safeguards (like automatic position size reduction for newbies, better margin call systems, or at least flashing big warnings). On the regulatory side, there might be moves to set leverage limits for retail if exchanges want to be compliant in certain jurisdictions.

In summary, regulators are cautiously circling the perp markets: some outright ban, some sue, some attempt to integrate them into the existing framework. It’s a bit of a whack-a-mole since crypto is borderless – when one jurisdiction clamps down, the activity moves elsewhere (often to the decentralized realm). The coming years will be interesting: we could see more formal acceptance of perps in mainstream finance, or conversely, harsher crackdowns that drive them further underground (or on-chain).

Conclusion: Perps – A Blessing, a Curse, or Just Reality?

Perpetual futures have undeniably become a cornerstone of crypto trading. They’ve pumped liquidity into the markets like an adrenaline shot, making it easier to trade and hedge large positions. They’ve enhanced price discovery, ensuring that information is quickly reflected in crypto prices (sometimes too quickly, as any sleep-deprived crypto trader can attest). And they’ve given us colorful concepts like the funding rate – a little interest payment dance that keeps markets (mostly) honest.

But perps have also brought leverage front and center, which means when things go wrong, they can go very wrong, very fast. We’ve seen how they can amplify both rallies and crashes, turn fake news into real volatility, and send traders to REKT-ville if they’re overexposed.

The influence of perps on market stability is a bit of a paradox: on one hand, they stabilize prices between futures and spot; on the other, they destabilize prices when the crowd gets overzealous and margin calls cascade.

For all the drama, it’s hard to imagine the crypto market without perps now. They’ve become the preferred way to trade for many – like the beating heart of the crypto-speculation machine. Love them or hate them, they’re likely here to stay, evolving as the market evolves. We’ll probably see more innovation (perhaps smoother funding mechanisms, or hybrid perp-options) and hopefully better risk management tools for users. And as the crypto industry matures, perhaps the wild swings of 50% days will calm to mere 15-20% swings… (Progress, right?)

For traders and enthusiasts, the key is understanding that perps are a powerful tool. Like a high-performance car, they can get you places fast, but can also crash spectacularly if you don’t know what you’re doing. Keep an eye on those funding rates, watch the leverage, and maybe keep the antacids handy on days when the market’s a sea of red.

In the end, perpetual futures have increased liquidity, sharpened price discovery, and added a new dimension to market dynamics – at the cost of introducing new risks and complexities. They’ve taken crypto markets from a mosh pit to a Formula 1 race: more thrills, more skill required, and the occasional fiery wreck.

So, next time you see Bitcoin’s price suddenly jolt or an altcoin inexplicably moon, chances are the perps had something to do with it. And if you ever trade these perpetual futures yourself, remember the lessons: nothing’s truly “perpetual” – except maybe the need to manage your risk and keep learning. Happy (and careful) trading!

Frequently Asked Questions

Basic Understanding

Q: What are perpetual futures?

A: Perpetual futures (or “perps”) are cryptocurrency derivatives with no expiration date, allowing traders to hold positions indefinitely. Unlike traditional futures that settle on specific dates, perps use a funding rate mechanism to keep their price aligned with the spot market.

Q: How do perpetual futures differ from traditional futures contracts?

A: The main differences are: 1) Perps never expire, while traditional futures settle on a predetermined date; 2) Perps use a funding rate mechanism to maintain price alignment with spot markets; 3) Perps typically offer higher leverage; and 4) Perps trade 24/7 on crypto exchanges and settle in cryptocurrency or stablecoins.

Q: Who invented perpetual futures?

A: BitMEX is credited with pioneering perpetual futures around 2016. Since then, they’ve been widely adopted across the cryptocurrency industry.

Mechanics and Trading

Q: What is the funding rate and how does it work?

A: The funding rate is a periodic payment between long and short traders (typically every 8 hours) that keeps perp prices aligned with spot prices. When perp price > spot price, funding is positive (longs pay shorts); when perp price < spot price, funding is negative (shorts pay longs). This incentivizes trading that pushes perp prices back toward spot prices.

Q: How much leverage can I use with perpetual futures?

A: Leverage varies by platform. Some exchanges offer from 5x up to 100x or more. However, higher leverage means higher risk of liquidation. Many exchanges have reduced their maximum leverage offerings after market crashes, and some implement lower limits for new users.

Q: Can I get liquidated trading perpetual futures?

A: Yes. If the market moves against your position and your margin falls below the maintenance requirement, your position will be automatically closed (liquidated). This is one of the primary risks of trading with leverage on perps.

Q: How can I use funding rates in my trading strategy?

A: Funding rates can be used as sentiment indicators. Extremely positive rates may signal an overcrowded long market (potential reversal risk), while deeply negative rates might indicate excessive bearishness. Some traders take counter-trend positions when funding gets extreme, while others use funding payments as part of an arbitrage strategy between perps and spot markets.

Market Impact

Q: Why do perpetual futures often have more volume than spot markets?

A: Perps attract higher volume because they offer leverage (allowing traders to control larger positions with less capital), easy shorting, lower fees in many cases, and continuous trading in a single contract (rather than fragmented across different expiry dates).

Q: How do perps influence price discovery in crypto markets?

A: Due to their high liquidity and leverage, perps often react fastest to new information and can lead price movements that spot markets follow. They effectively concentrate trading activity and information in a single highly liquid market per asset, improving price efficiency while sometimes causing short-term volatility.

Q: Did perpetual futures cause the major crypto crashes?

A: While perps didn’t “cause” crashes like Black Thursday (March 2020) or May 19, 2021, they significantly amplified these events through liquidation cascades. When prices moved against heavily leveraged positions, forced liquidations created feedback loops that exacerbated price movements.

Risks and Considerations

Q: What are the main risks of trading perpetual futures?

A: Key risks include: 1) Liquidation risk from using leverage; 2) Funding rate costs that can accumulate over time; 3) Volatility amplification during market stress; 4) Potential exchange or counterparty risk; and 5) Regulatory uncertainty in many jurisdictions.

Q: Are perpetual futures regulated?

A: Regulation varies by jurisdiction. In the U.S., perps are considered swaps and offering them to retail customers outside regulated derivatives exchanges is generally prohibited. Many countries are developing frameworks for crypto derivatives, with approaches ranging from outright bans (UK for retail) to regulated allowance. Many exchanges geofence certain regions to comply with local laws.

Q: Are decentralized perpetual futures safer than centralized ones?

A: Decentralized perps eliminate exchange custody risk but introduce smart contract risk and can have different liquidation mechanisms. They generally offer better transparency but may have lower liquidity and different fee structures. Neither is inherently “safer” – each has different risk tradeoffs.

Future Developments

Q: What is the future of perpetual futures in crypto?

A: Likely developments include: 1) Growth in decentralized perp platforms; 2) Expansion to non-crypto assets like commodities or equity indices; 3) More institutional participation; 4) Evolving regulatory frameworks; and 5) Improved risk management tools and education.

Q: Will traditional finance adopt perpetual futures?

A: There are indications that aspects of the perpetual futures model could be adapted for traditional markets. Some platforms are already experimenting with perp-like instruments for traditional assets. Regulated venues like CME have considered similar products, though regulatory hurdles remain significant.

Q: How are decentralized perpetual futures different from centralized ones?

A: Decentralized perps operate on blockchain infrastructure using smart contracts rather than exchange order books. They allow traders to maintain custody of their assets, often use price oracles instead of direct market makers, and may use different funding and liquidation mechanisms. Trading volumes on decentralized perps are growing rapidly but remain smaller than centralized alternatives.

Practical Advice

Q: What should beginners know before trading perpetual futures?

A: Beginners should: 1) Understand funding rates and how they affect positions; 2) Start with very low leverage or none at all; 3) Use stop losses to manage risk; 4) Be aware of liquidation thresholds; 5) Practice on testnet or with small amounts first; and 6) Understand that perps can amplify both gains and losses.

Q: How can I manage risk when trading perpetual futures?

A: Effective risk management includes: 1) Using lower leverage (or none); 2) Setting stop losses; 3) Monitoring funding rates; 4) Not overexposing your portfolio to a single position; 5) Being cautious during high volatility; and 6) Having a clear strategy rather than trading on emotions.

Q: Where can I learn more about advanced perpetual futures trading strategies?

A: Beyond this article, you can explore exchange documentation, trading communities, educational platforms focused on crypto derivatives, and market analysis from research firms that specialize in crypto futures markets. Many exchanges also offer educational resources specifically about perpetual futures.